Loading

Get Employer Report Of Employee Earnings

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employer Report of Employee Earnings online

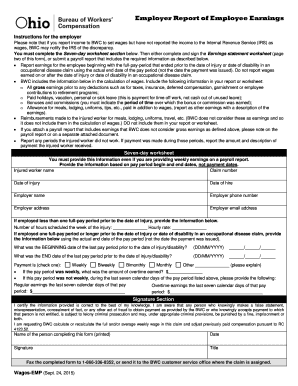

Filling out the Employer Report of Employee Earnings is a crucial step in reporting employee wages accurately to the Bureau of Workers' Compensation (BWC). This guide provides clear, step-by-step instructions on how to fill out the form online, ensuring compliance and accuracy.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to access the Employer Report of Employee Earnings, allowing you to initiate the process of completing the form online.

- Review the instructions provided at the top of the form carefully. It is important to understand that income reported to the BWC must be distinguishable from what has been reported to the Internal Revenue Service (IRS).

- Fill out the Seven-day worksheet section. Here, enter the injured worker's name, claim number, date of injury, date of hire, and employer's contact information, including phone number, address, and email.

- If the employee worked less than one full pay period prior to the date of injury, include the number of hours scheduled the week of the injury and the applicable hourly rate.

- For those employed one full pay period or longer prior to the date of injury, enter the beginning and ending dates of the last pay period preceding the injury, ensuring the dates reflect the actual end of the pay period, not the payment issuance date.

- Indicate the frequency of payment. Check the appropriate box for whether the payment is weekly, biweekly, bimonthly, monthly, or other (providing an explanation if necessary).

- If applicable, include the overtime earnings amount for the last pay period and detail the regular and overtime earnings for the past seven calendar days.

- Review the Signature section to certify the accuracy of the information provided. Ensure to print the name, date, and title of the person completing the form.

- Finally, save changes, and proceed to download or print the form. Ensure the completed form is faxed to 1-866-336-8352 or sent to the appropriate BWC customer service office.

Complete the Employer Report of Employee Earnings online to ensure accurate reporting and compliance.

A payroll register gives the employee's gross earnings, net earnings, deductions and taxes for specific pay period with totals for all employees also being recorded.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.