Loading

Get 01-116-a (rev

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

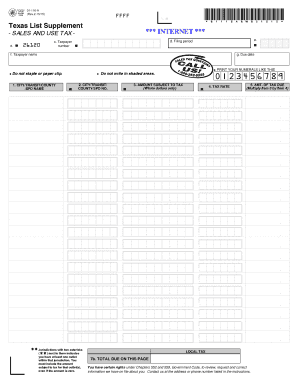

How to fill out the 01-116-A (Rev online

Filling out the 01-116-A (Rev) form can seem daunting, but this guide provides clear instructions to help users complete it efficiently and accurately. Follow these steps for a seamless experience while filing your sales and use tax information online.

Follow the steps to successfully complete the online form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your taxpayer number in the designated field labeled 'Taxpayer number'. This number is essential for the identification of your account.

- Fill in the 'Taxpayer name' field with the official name associated with your taxpayer number. Ensure that the name is accurate to avoid complications.

- Specify the 'Filing period' for which you are reporting. This indicates the duration for which the sales and use tax is being calculated.

- Indicate the 'Due date' for the tax submission. Ensure to meet this date to avoid any penalties.

- For sections marked with asterisks, input the 'Amount subject to tax' based on your sales in the respective jurisdictions. Remember, even if the amount is zero for certain outlets, you must still report it.

- Enter the applicable 'Tax rate' in the next field. This rate varies depending on the location of your business operations.

- Calculate the 'Amount of tax due' by multiplying the amount subject to tax by the tax rate. Input the calculated figure in the designated field.

- Finally, sum up the total due as indicated in the relevant section and ensure all calculations are correct before submitting.

- Once you have completed the form, you can save changes, download, print, or share the form as needed.

Complete your 01-116-A (Rev online form today for an efficient filing experience.

Federal and Texas government entities are automatically exempt from applicable taxes. Nonprofit organizations must apply for exemption with the Comptroller's office and receive exempt status before making tax-free purchases.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.