Loading

Get Nonexempt Earnings Statement - Justicecourts Maricopa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nonexempt Earnings Statement - Justicecourts Maricopa online

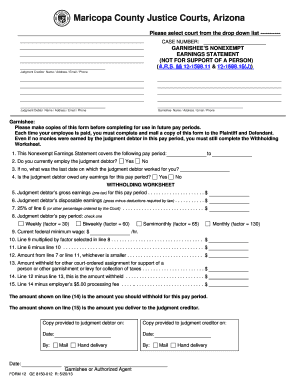

Filling out the Nonexempt Earnings Statement is a crucial step for employers involved in the garnishment process. This guide provides clear and supportive instructions on how to complete the form effectively online.

Follow the steps to accurately fill out the Nonexempt Earnings Statement.

- Click 'Get Form' button to obtain the form and open it in the online editor.

- Begin by selecting the appropriate court from the drop-down list and enter the case number carefully.

- Fill in the names, addresses, email, and phone numbers for the judgment creditor, garnishee, and judgment debtor accurately.

- Indicate the pay period that this Nonexempt Earnings Statement covers.

- State whether you currently employ the judgment debtor by selecting 'Yes' or 'No'. If 'No', provide the last date the judgment debtor worked for you.

- Specify if the judgment debtor is owed any earnings for the current pay period by selecting 'Yes' or 'No'.

- In the Withholding Worksheet, enter the judgment debtor's gross earnings (pre-tax) for this pay period.

- Calculate the judgment debtor’s disposable earnings by subtracting legally required deductions from their gross earnings.

- Determine and record 25% of the disposable earnings or any other percentage as ordered by the court.

- Select the judgment debtor’s pay period frequency (weekly, biweekly, etc.) and note the corresponding factor.

- Multiply the current federal minimum wage by the factor selected to find the applicable threshold.

- Subtract the amount in line 10 from line 6 to find the remaining disposable earnings.

- Choose the lesser amount between line 7 and line 11 to establish the amount subject to withholding.

- Input any existing amounts withheld for other court orders or garnishments, and calculate the final withholding amount.

- After completing all calculations, you can save changes, download, print, or share the completed form.

Complete the Nonexempt Earnings Statement online today to ensure accurate processing.

A wage garnishment expires 182 days after service on the employer. That's easy. But the judgement in 2002 for a debt may have expired.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.