Loading

Get Winegrower Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Winegrower Return online

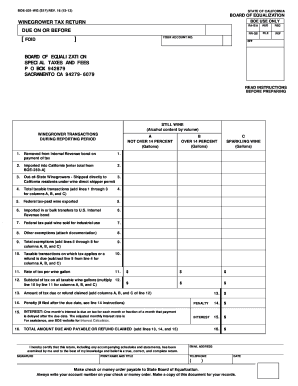

The Winegrower Return is a critical document for winegrowers and wine blenders in California, used to report transactions and assess taxes on wine. This guide provides a clear, step-by-step process for completing the form online, ensuring you submit accurate and timely information.

Follow the steps to complete the Winegrower Return efficiently.

- Press the ‘Get Form’ button to access the Winegrower Return form and open it in your chosen editor.

- Begin by reviewing the instructions provided at the top of the form. Ensure you familiarize yourself with the required reporting period and any pertinent details before entering data.

- In the section for wine transactions during the reporting period, fill in the gallons of still wine removed from Internal Revenue bond on payment of tax (line 1). This figure represents the total gallons for which you have paid federal excise tax.

- Enter the total gallons of wine imported into California (line 2). You must support this amount with a completed BOE-269-A report.

- For out-of-state winegrowers, enter the total gallons of wine shipped directly to California residents under a wine direct shipper permit (line 3). Ensure that this reflects the gallons on which California excise tax has not yet been paid.

- Calculate the total taxable transactions by adding the gallons reported in lines 1, 2, and 3 (line 4) for all applicable categories of wine.

- For exemption claims, report federal tax-paid wine exported (line 5) and any other exemptions on lines 6 through 8, providing necessary documentation for each exemption.

- Determine the total exemptions by summing the amounts reported on lines 5 through 8 (line 9).

- Calculate the taxable transactions by subtracting the total exemptions on line 9 from the total taxable transactions on line 4 (line 10).

- Identify the rate of tax per wine gallon (line 11) and multiply the total taxable gallons from line 10 by the tax rate (line 12).

- Calculate the total amount of tax due or refund claimed by adding the totals from line 12 (line 13).

- If applicable, enter any penalties for late filing (line 14) and calculate any interest due on late tax payments (line 15).

- Finally, sum lines 13, 14, and 15 (line 16) to determine the total amount due and payable or refund claimed.

- Review the completed Winegrower Return for accuracy, and then save your changes. You can download, print, or share the finalized document as needed.

Begin filling out your Winegrower Return online today to ensure compliance and avoid penalties.

Examples of purchases that may be subject to use tax in California include: Items purchased from an out-of-state seller and shipped to California, such as an online retailer, catalog company, or TV home shopping network. Items purchased in another state and brought into California for use, storage, or other consumption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.