Loading

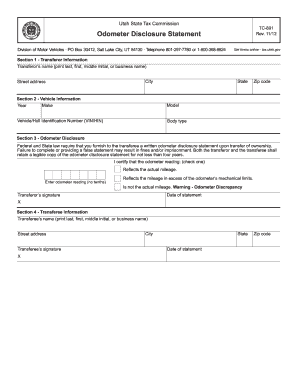

Get Odometer Disclosure Statement - Utah State Tax Commission - Tax Utah

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Odometer Disclosure Statement - Utah State Tax Commission - Tax Utah online

The Odometer Disclosure Statement is a vital document required for the transfer of vehicle ownership in Utah. This guide will provide you with step-by-step instructions on how to accurately complete this form online, ensuring compliance with state regulations.

Follow the steps to accurately complete the odometer disclosure statement.

- Click ‘Get Form’ button to access the form and open it in your chosen editor.

- In Section 1, provide the transferor information. This includes the transferor’s name, which should be printed with the last name first, followed by the first name and middle initial, or business name. Fill in the street address, city, state, and zip code.

- Proceed to Section 2 to enter the vehicle information. This section requires details such as the make, year, model, and Vehicle/Hull Identification Number (VIN/HIN). Additionally, indicate the body type of the vehicle and the zip code.

- In Section 3, complete the odometer disclosure. You must select one of the three options regarding the mileage: whether it reflects the actual mileage, exceeds mechanical limits, or is not the actual mileage due to an odometer discrepancy. Enter the odometer reading (without tenths) if applicable and sign and date the statement.

- Next, fill out Section 4, which contains the transferee information. Provide the transferee’s name, street address, city, state, and zip code. The transferee must also sign and date the statement.

- Once all sections are complete, review the form for accuracy and completeness. You can then save your changes, download a copy, print it, or share the completed form as needed.

Ensure all your vehicle transfer documents are complete by filing forms online.

The mileage on a title may be corrected by obtaining an amended odometer statement from the seller who incorrectly reported the mileage in the first place. A corrected title application can then be processed at any Secretary of State branch office.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.