Loading

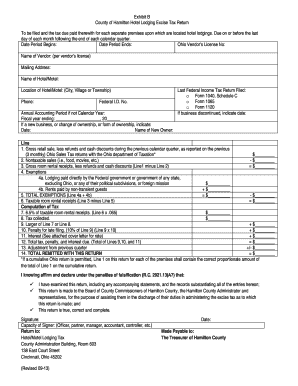

Get Exhibit B County Of Hamilton Hotel Lodging Excise Tax Return To Be Filed And The Tax Due Paid

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Exhibit B County Of Hamilton Hotel Lodging Excise Tax Return To Be Filed And The Tax Due Paid online

Completing the Exhibit B County Of Hamilton Hotel Lodging Excise Tax Return is a crucial step for those managing hotel lodgings in Hamilton County. This guide will assist users in filling out the form accurately and efficiently online while ensuring compliance with tax requirements.

Follow the steps to complete your tax return online successfully.

- Click ‘Get Form’ button to access the tax return form and open it in your preferred editor.

- Enter the date period begins and date period ends, which indicates the quarterly reporting period.

- Fill in your Ohio vendor’s license number, name of vendor (as per your vendor’s license), and your mailing address.

- Provide the name and location of the hotel or motel, including the city, village, or township.

- Input your contact phone number and federal I.D. number.

- If applicable, indicate the annual accounting period if it is not the calendar year, including the fiscal year ending.

- If you are a new business or have had changes in ownership, provide the date and name of the new owner.

- Record the last Federal Income Tax return filed, selecting the appropriate form from the options provided.

- If the business has been discontinued, indicate the date of discontinuation.

- Complete the financial figures for Line 1: gross retail sale, less refunds and cash discounts, reported as instructed.

- Continue to Line 2 to enter nontaxable sales (e.g., food, movies, etc.).

- Calculate and enter the gross room rental receipts on Line 3 (Line 1 minus Line 2).

- For exemptions, complete Line 4a and Line 4b, indicating any lodgings paid directly by the Federal government and rents from non-transient guests.

- Sum the exemptions and enter the total on Line 5 (Line 4a plus Line 4b).

- Calculate taxable room rental receipts on Line 6 (Line 3 minus Line 5).

- Determine 6.5% of the taxable room rental receipts and fill in Line 7.

- Document the tax collected on Line 8.

- On Line 9, enter the larger amount between Line 7 or Line 8.

- Calculate any penalty for late filing, which is 10% of Line 9, and write it on Line 10.

- Include any interest as indicated in the attached cover letter on Line 11.

- Tally the total tax, penalty, and interest due on Line 12 (total of Lines 9, 10, and 11).

- If you have any adjustments from the previous quarter, indicate them on Lines 13.

- Calculate the total remitted with this return on Line 14.

- Affirm the accuracy of the return with your signature and capacity as the signer.

- Finally, save your changes, and if necessary, download, print, or share the completed form.

Begin completing your Exhibit B tax return online today!

Property owners and managers are required to pay lodging tax for renting out a room or property in certain states or localities. In some regions, lodging tax may also be known by another name such as: stay tax, occupancy tax, room tax, sales tax, tourist tax, or hotel tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.