Loading

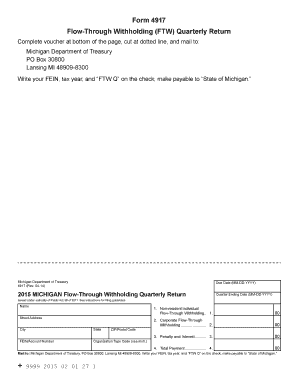

Get Form 4917 Flow-through Withholding (ftw ... - State Of Michigan - Michigan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4917 Flow-Through Withholding (FTW) - State Of Michigan online

Filling out the Form 4917 Flow-Through Withholding (FTW) is essential for reporting withholding payments in Michigan. This guide will provide a step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to complete the Form 4917 Flow-Through Withholding online.

- Click the ‘Get Form’ button to obtain the document and open it in your preferred form editor.

- Enter the due date in MM-DD-YYYY format, indicating when the form is due.

- Fill in the quarter ending date in the same MM-DD-YYYY format to specify the period for which you are reporting.

- Provide your name, street address, city, state, and ZIP/Postal Code in the sections designated for personal information.

- Input your FEIN or account number in the appropriate field, ensuring it is accurate for identification purposes.

- Select the organization type code from the provided options that best describes your situation, as indicated in the instructions.

- Complete the Flow-Through Withholding amounts for non-resident individuals and corporate flow-through withholding as applicable, ensuring total accuracy in your calculations.

- If there are any penalties or interest, indicate the amounts in the corresponding fields.

- Calculate the total payment owed, adding all relevant amounts together to arrive at the final figure to report.

- Prepare to submit your payment by cutting out the voucher at the bottom of the page. Mail it along with your check payable to 'State of Michigan' at the address provided.

- You can save your completed form, download it for your records, print a physical copy, or share it directly as needed.

Encouraging completing your documents online can streamline the process and ensure accuracy.

A withholding tax is an amount that an employer withholds from employees' wages and pays directly to the government. The amount withheld is a credit against the income taxes the employee must pay during the year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.