Loading

Get 22 Nebraska Change Request - Nebraska Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 22 Nebraska Change Request - Nebraska Department Of Revenue online

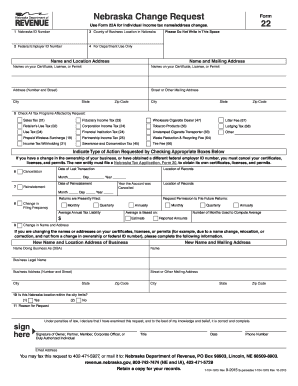

Filling out the 22 Nebraska Change Request form is essential for making updates to your business information with the Nebraska Department of Revenue. This guide provides comprehensive, step-by-step instructions to ensure your changes are submitted correctly and efficiently.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Nebraska ID number. This should be the identification number assigned to your business by the Nebraska Department of Revenue, not your Social Security number.

- Input your federal employer ID number if you have one. If you have applied for one, simply indicate 'Applied For'.

- Specify the county in which your business is located in Nebraska.

- Fill in the name and address fields with the information currently held by the Nebraska Department of Revenue or printed on your certificate, license, or permit.

- Check all applicable tax programs that are affected by your request. Carefully review and ensure that you mark every relevant box for your situation.

- If you are canceling a tax program, fill in the date of your last transaction.

- Indicate if you are requesting a reinstatement of any canceled tax programs and fill in the corresponding dates.

- If changing your filing frequency for sales and use tax, indicate your average annual tax liability and the basis for this estimate.

- Complete the fields for the new name and address of your business if applicable, ensuring to provide a street address and not a P.O. Box.

- Answer whether the Nebraska location is within city limits and provide a detailed reason for the request, including any ownership changes.

- Ensure the form is signed by an authorized individual and provide their title, date, phone number, and email address.

- Once all fields are completed accurately, users can save changes, download, print, or share the form as needed.

Complete your form online now to ensure your changes are processed efficiently.

Taxes and Spending in Nebraska. The sales and use tax is generally considered a tax on consumption. It is usually added to the purchase price of any retail sale, collected by the seller and returned to the state. The state collects the state and all municipal sales taxes except the tax on motor vehicles.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.