Loading

Get Mercer County Net Profits License Fee Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mercer County Net Profits License Fee Return online

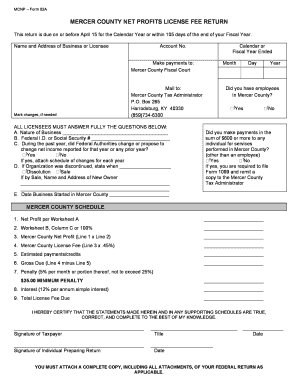

This guide provides detailed instructions on how to complete the Mercer County Net Profits License Fee Return online, ensuring that users can navigate the process smoothly. Follow the step-by-step instructions to ensure accurate filing and compliance with local regulations.

Follow the steps to successfully complete your return.

- Click ‘Get Form’ button to access the Mercer County Net Profits License Fee Return and open it in the online editor.

- Begin by filling in the name and address of your business or licensee in the provided fields. Ensure that this information is accurate to avoid any discrepancies.

- Enter your account number in the designated field. This number is crucial for identifying your tax records.

- Specify the calendar or fiscal year for which you are filing the return. This determines the tax period applicable to your net profits.

- Indicate the date your business started operating in Mercer County. This information is necessary for county records.

- Follow the prompt to address the questions regarding business operations. For example, indicate if you had employees in Mercer County and if you made any payments to individuals over $600 for services performed.

- Complete the Mercer County Schedule section by calculating your net profit based on the instructions provided. Fill in each line accurately based on your financial records.

- Certify the information by providing your signature and the date. If someone else prepares the return, they must also sign it and indicate their title.

- Ensure that you attach all necessary documentation, including a complete copy of your federal tax return, as required.

- Finally, review all entries for accuracy. You can then save your changes, download the completed form, print it for your records, or share it as needed.

Complete your Mercer County Net Profits License Fee Return online today and ensure timely submission.

Occupational Licensing & Net Profit Requirements Each following year you will be required to file a form NP (net profit return) and pay a fee based on 1.75% of the net profit earned from sales within the City of Danville and 1.25% of the net profit earned within the County of Boyle.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.