Get New York State Department Of Taxation And Finance Certificate For Purchases Of Non-highway Diesel

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New York State Department Of Taxation And Finance Certificate For Purchases Of Non-Highway Diesel online

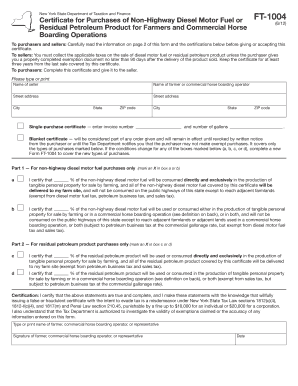

Filling out the New York State Department Of Taxation And Finance Certificate For Purchases Of Non-Highway Diesel is a crucial step for farmers and commercial horse boarding operators to obtain diesel fuel exemptions. This guide will provide you with clear, step-by-step instructions to complete this form accurately.

Follow the steps to successfully complete the certificate online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter the name of the seller in the designated field. This refers to the business or individual selling the non-highway diesel.

- Provide the name of the farmer or commercial horse boarding operator. Ensure this is accurately spelled to avoid any issues.

- Fill in the street address, city, state, and ZIP code for both the seller and the purchaser. Verify the accuracy of each entry.

- If applicable, indicate whether this is a single-purchase certificate by entering the invoice number and the number of gallons in the specified section.

- Decide between a single-purchase certificate or a blanket certificate. If opting for a blanket certificate, understand that it remains effective until a written notice of cancellation is provided.

- In Part 1, mark an X in box 'a' or 'b' to certify the purpose of the non-highway diesel motor fuel purchase. Provide the percentage for each if needed.

- In Part 2, for residual petroleum product purchases, mark an X in box 'c' or 'd' based on the intended usage and complete the percentage as required.

- Complete the certification statement, affirming that the information provided is true and that you acknowledge the legal implications for false statements.

- Type or print the name of the farmer, commercial horse boarding operator, or their representative, then provide the signature and date.

- After completing the form, save your changes, and choose to download, print, or share the form as necessary to complete your submission.

Complete your New York State Department of Taxation And Finance Certificate For Purchases Of Non-Highway Diesel online today to ensure your tax exemptions.

Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. The purchaser fills out the certificate and gives it to the seller. The seller keeps the certificate and may then sell property or services to the purchaser without charging sales tax.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.