Loading

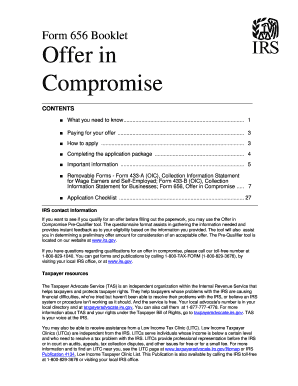

Get Form 656-b Rev 2-2016 Form 656 Booklet Offer In Compromise - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 656-B Rev 2-2016 Form 656 Booklet Offer In Compromise - Irs online

Filling out the Form 656-B Rev 2-2016, known as the Offer in Compromise Booklet, can be an important step for taxpayers seeking to settle their tax debts with the IRS for less than the full amount owed. This guide offers clear and detailed instructions on how to complete the form online to facilitate the process.

Follow the steps to successfully complete your Form 656-B Rev 2-2016 Offer In Compromise.

- Click the 'Get Form' button to obtain the Form 656-B Rev 2-2016 and open it in your browser or PDF editor.

- Begin by carefully reviewing the introductory sections that provide essential information about what an Offer in Compromise is and the prerequisites for submitting the form.

- Gather all necessary documentation regarding your financial situation, including income statements and details of any assets, as this information is crucial for accurate completion.

- Complete Form 433-A (OIC) if you are an individual wage earner or self-employed, providing detailed information on your income, expenses, and assets.

- If applicable, also fill out Form 433-B (OIC) for businesses, disclosing similar financial details for your business assets and liabilities.

- Once your financial statements are completed, fill out Form 656. Indicate the applicable tax years, the type of tax owed, and provide your offer amount along with the proposed payment structure.

- Include your initial payment based on the selected payment option, along with the $186 application fee, unless you qualify for a waiver due to low income.

- Double-check that all forms are signed and all required supporting documentation is attached, including forms 433-A and/or 433-B.

- Mail your completed application package to the correct IRS processing center for your state. Consider using certified mail for tracking purposes.

- Keep a copy of all submitted documents for your records. Monitor for any communication from the IRS regarding your application status.

Start filling out your Form 656-B Rev 2-2016 online today to take the first step toward resolving your tax debts.

How much will the IRS settle for? The IRS will typically only settle for what it deems you can feasibly pay. To determine this, it will take into account your assets (home, car, etc.), your income, your monthly expenses (rent, utilities, child care, etc.), your savings, and more.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.