Loading

Get Form Et-133:4/14:application For Extension Of Time To File And/or ... - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form ET-133:4/14:Application For Extension Of Time To File And/or Pay Estate Tax - Tax Ny online

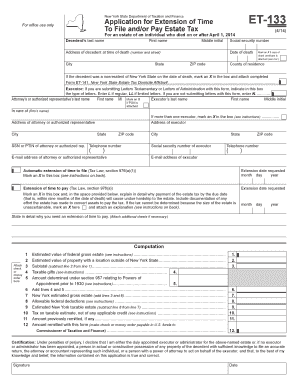

Filing Form ET-133 is an essential step for individuals seeking to extend their time to file or pay estate tax in New York State. This guide aims to simplify the process of completing the form online, ensuring all users, regardless of their prior experience, can navigate it with ease.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering the decedent's information, including their last name, first name, middle initial, and social security number. Ensure the details are accurate to avoid processing delays.

- Provide the decedent’s address at the time of death, including the street number, city, county, state, and ZIP code. This information helps the tax department identify the decedent’s residency.

- Indicate the date of death. It is crucial to enter the correct date, as it affects the deadlines associated with the estate tax.

- Attach a copy of the death certificate if not previously submitted. Mark the corresponding box on the form.

- If the decedent was a nonresident of New York State, mark the appropriate box and provide a completed Form ET-141,New York State Estate Tax Domicile Affidavit.

- If applicable, provide details about the executor, including their name, contact information, and specify if Letters Testamentary or Letters of Administration are included.

- Indicate whether there is more than one executor by marking the box if applicable and providing details of all executors on a separate list.

- Request an extension by marking the appropriate box for either time to file or time to pay. Fill out the requested extension date.

- For requesting an extension to pay, offer detailed explanations for the need for an extension and attach any necessary documentation relating to the estate's financial status.

- Complete the computation section by filling in estimated values for the estate, gifts, and any deductions. Make sure all values are accurate and supported by documentation.

- Sign the certification section to declare the truthfulness of the information provided and ensure to include the date of signing.

- Once completed, save your changes. You can then download, print, or share the form as necessary.

Complete your Form ET-133 online today to ensure timely processing of your estate tax extension.

What Tax Returns Should Be Filed When a Person Dies? The Executor or Administrator of an Estate may be required to file three separate returns: an individual tax return for the decedent, estate income tax return and estate tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.