Loading

Get Crs 1 Long Form Combined Report System

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Crs 1 Long Form Combined Report System online

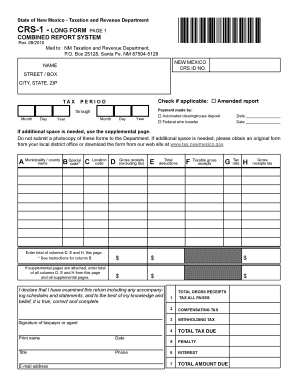

Filling out the Crs 1 Long Form Combined Report System is a crucial step for individuals and businesses reporting gross receipts in New Mexico. This guide will provide you with clear, step-by-step instructions to complete the form online efficiently and accurately.

Follow the steps to successfully complete the Crs 1 Long Form.

- Press the ‘Get Form’ button to obtain the Crs 1 Long Form and open it in your form editor.

- Begin by entering your CRS ID number in the designated field. This is essential for identifying your tax account.

- Fill in your name, street address or P.O. Box, city, state, and ZIP code in the appropriate sections.

- Indicate if you are submitting an amended report by checking the corresponding box if applicable.

- Enter the reporting period for which you are filing the form. Provide starting and ending dates in month, day, and year format.

- Select your payment method. Indicate whether you made the payment through automated clearinghouse deposit or federal wire transfer.

- Fill out the sections labeled A through H for each location as necessary, making sure to detail gross receipts, total deductions, taxable gross receipts, and tax rate per location.

- If you need additional space for reporting, utilize the supplemental page by entering totals for each corresponding column from the primary page.

- Review all entered information to ensure accuracy. Incorrect submissions may result in processing delays or penalties.

- Finally, sign the form indicating your declaration that the information is true and complete. Include your printed name, date, title, phone number, and email address.

- After completing the form, you can save changes, download, print, or share the form as needed.

Complete your Crs 1 Long Form Combined Report online today to ensure timely and accurate filing.

We offer two ways to obtain a CRS identification number. You can submit an ACD-31015, Application for Business Tax Identification Number to any local tax office. For instructions on completing this form click here. You can also apply for a CRS identification number online.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.