Loading

Get De 9423

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the De 9423 online

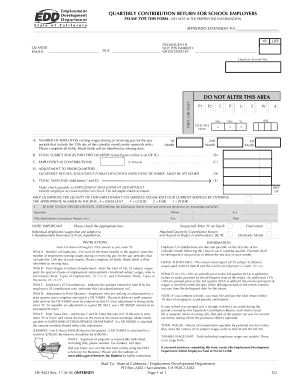

Filling out the De 9423 form online can streamline the submission process for school employers needing to report quarterly contributions. This guide offers clear, step-by-step instructions to help users successfully complete the form.

Follow the steps to accurately fill out the De 9423 form.

- Press the ‘Get Form’ button to access the De 9423 form online and open it in your preferred editor.

- In section A, enter the number of employees who earned wages during or received pay for the pay periods including the 12th day of each month. Provide numerals only for all three months.

- For section B, input the total subject wages paid this quarter. Ensure that this amount reflects the same figure as line L on form DE 9C.

- In section C, calculate the employer's Unemployment Insurance (UI) contributions by multiplying the total wages from section B by the employer's UI contribution rate and write this amount in the space provided.

- If applicable, complete section D to report adjustments to prior quarters. Attach a Quarterly Return Adjustment Form for School Employers (DE 938SEF) if needed, and enter the total adjustment amount in the indicated field.

- For section E, add the amounts from sections C and D to determine the total taxes due, and write this sum in the designated area. If there are no taxes due, enter '0' in this section.

- In section F, sign and date the form. Include the preparer’s title, phone number, and fax number to complete the form.

- Once all fields are filled accurately, save your changes, and choose to download, print, or share the completed De 9423 form based on your preference.

Complete your De 9423 form online today for a more efficient filing process!

Related links form

You can get a paper Claim for Disability Insurance (DI) Benefits (DE 2501) form by: Ordering a form onlineto have it mailed to you. Getting the form from your licensed health professional or employer. Visiting an SDI Office. Calling 1-800-480-3287 and selecting DI Information option 3 to request a paper form by mail.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.