Loading

Get Schedule W 2005-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule W online

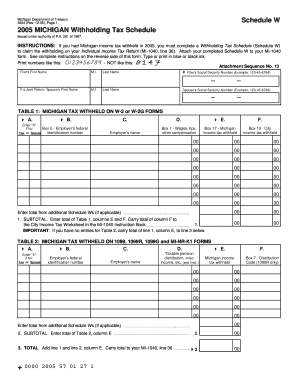

Completing Schedule W is essential for individuals who want to claim their Michigan withholding tax effectively. This guide provides a clear, step-by-step process to help users accurately fill out this form online.

Follow the steps to complete your Schedule W online.

- Click the ‘Get Form’ button to access the Schedule W and open it in the editing interface.

- Begin by entering your information in the Filer's section, including your first name, middle initial, last name, and Social Security number. If filing jointly, include your partner’s information.

- Proceed to Table 1 where you will list the Michigan tax withheld from your W-2 or W-2G forms. Mark with an 'X' to indicate if the information is for you or your partner, then input the employer's federal identification number and name.

- Fill in the wages and the Michigan income tax withheld amounts from your W-2 forms in the respective columns (Box 1 for wages and Box 17 for tax withheld).

- Calculate the subtotal for Table 1 by totaling the amounts entered in columns E and F. Carry the total from column F to the City Income Tax Worksheet as directed.

- Next, move to Table 2 if applicable. This section is for any tax withheld from 1099, 1099R, 1099G, and MI-NR-K1 forms. Again, indicate whose income this represents.

- Enter the employer’s federal identification number, employer's name, and the taxable amounts as noted. Complete this section as you did with Table 1.

- Once you have computed the subtotals for Table 2, add the total from line 1 of Table 1 to the total from line 2 of Table 2 to get the overall total. This amount should be carried to your MI-1040, line 36.

- Review all entered information for accuracy. Once everything is complete, save your changes, and choose to download, print, or share the Schedule W as required.

Complete your documents online today and ensure your taxes are filed accurately!

An employee may claim exemption from Michigan income tax withholding only if they do not anticipate a Michigan income tax liability for 2017 because employment is less than full time AND exemption allowances are greater than annual compensation. ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.