Loading

Get Arw 3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Arw 3 online

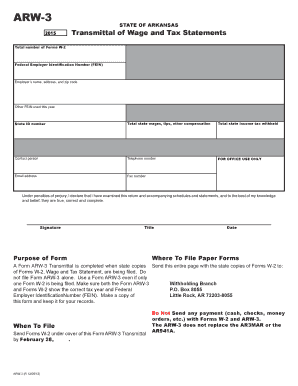

Filling out the Arw 3 form accurately is essential for submitting wage and tax statements to the state of Arkansas. This guide will walk you through each section of the form to ensure you can complete it efficiently and correctly.

Follow the steps to complete your Arw 3 form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the total number of Forms W-2 you are submitting. This is essential for tracking your filings accurately.

- Provide your Federal Employer Identification Number (FEIN). This number identifies your business for tax purposes.

- Fill in your employer's name, address, and zip code. Make sure all details are correct to avoid delays or issues.

- If applicable, enter any other FEIN used during the year for clarity and accurate processing.

- Indicate your State ID number to link your submission to your state tax records.

- Enter the total state wages, tips, and other compensation that you are reporting for accuracy.

- Provide the total state income tax withheld. Ensure that this amount matches your W-2 forms.

- Designate a contact person and include their telephone number. This will facilitate communication if there are questions regarding your submission.

- For office use only, provide an email address and fax number if necessary, which can assist with further processing of your form.

- Sign the form to declare that you have reviewed the information and it is true and complete. Input your title and the date of submission.

- After completing all fields, review your entries for accuracy. You can then save changes, download, print, or share the form as needed.

Ensure all your documents are completed correctly by taking advantage of online filing options.

All new employees for your business must complete a federal Form W-4. New employees also should complete one of two related Arkansas forms: Form AR4EC, Employee's Withholding Exemption Certificate, or Form AR4ECSP,Employee's Special Withholding Exemption Certificate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.