Loading

Get Attestation De R Sidence - Impots.gouv.fr - Altamir

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ATTESTATION DE R SIDENCE - Impots.gouv.fr - Altamir online

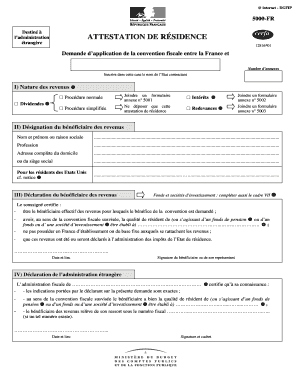

The ATTESTATION DE R SIDENCE is an essential document for claiming tax treaty benefits between France and other countries. This guide will walk you through the necessary steps to effectively complete this form online, ensuring that your information is accurate and compliant with tax regulations.

Follow the steps to complete your ATTESTATION DE R SIDENCE form online.

- Click the ‘Get Form’ button to access the ATTESTATION DE R SIDENCE – Impots.gouv.fr - Altamir form.

- Fill in the 'Nature des revenus' section by checking the appropriate box indicating the type of income you are declaring, such as 'dividendes' or 'intérêts', and include any applicable annex forms.

- Complete the 'Désignation du bénéficiaire des revenus' section. Enter your full name or business name, your profession, and your complete address, or the business address if applicable.

- In the 'Déclaration du bénéficiaire des revenus' section, certify that you are the beneficial owner of the income and indicate your residency status as defined by the relevant tax treaty.

- The declaration must also confirm that you do not maintain a permanent establishment in France and that the income will be reported to your home tax authority.

- In the 'Déclaration de l’administration étrangère' section, this must be completed by the foreign tax authority, certifying your residency and that the information you provided is correct.

- Complete the 'Déclaration de l’établissement payeur' section with the name, address, and SIREN number of the paying establishment certifying that the net income has been paid.

- For US residents, fill out the 'Déclaration de l’établissement financier américain' section, certifying your residency in the USA.

- Complete any additional sections relevant to funds or investment entities where necessary.

- Fill out the 'En cas de remboursement direct par l’administration' section if applicable, indicating where any refunds should be sent.

- Finally, review all the information provided, then save, download, print, or share the completed form as necessary.

Complete your forms efficiently and accurately online today!

Ce document, appelé "Attestation de résidence fiscale française des travailleurs frontaliers franco-suisses" est à faire remplir par son employeur et renvoyer à l'administration fiscale française.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.