Loading

Get R 1201 2015 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R 1201 2015 Form online

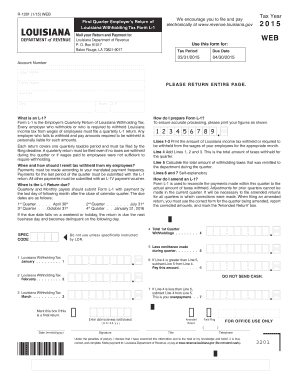

The R 1201 2015 Form is a crucial document for employers in Louisiana to report withholding taxes. This guide provides step-by-step instructions to ensure a smooth and accurate online submission of the form.

Follow the steps to fill out your R 1201 2015 Form online effectively.

- Click the ‘Get Form’ button to obtain the R 1201 2015 Form and access it in your browser or document editor.

- Enter your account number, legal name, and trade name in the appropriate fields.

- Complete the address section, including your city, state, and ZIP code, ensuring all details are accurate.

- Indicate the tax period and tax year, specifically noting 2015.

- For Lines 1-3, print the amount of Louisiana income tax withheld from the wages of your employees for each month of the quarter.

- Sum the amounts from Lines 1, 2, and 3 on Line 4 to determine the total amount of taxes withheld for the quarter.

- On Line 5, input the total amount of withholding taxes that were remitted to the department during the quarter.

- Line 6 is calculated by subtracting Line 5 from Line 4 if Line 4 is greater. This represents the amount you must pay.

- Line 7 will show your overpayment if Line 4 is less than Line 5 by subtracting Line 4 from Line 5.

- Check the box if this is a final return and enter the date the business was sold or closed.

- Provide your signature, title, and telephone number in the designated fields.

- Double-check all entries for accuracy before finalizing your submission.

- Save changes to the form, then download it for your records or print it out to send to the Louisiana Department of Revenue.

Complete your R 1201 2015 Form online to ensure compliance with Louisiana withholding tax requirements.

Related links form

The Louisiana Department of Revenue, opens a new window (LDR) provides free digital copies, opens a new window of tax forms. You can also get tax forms mailed to you at no cost by ordering forms online, opens a new window or calling the LDR at 888.829. 3071 and selecting option 6.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.