Loading

Get Tc-937

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TC-937 online

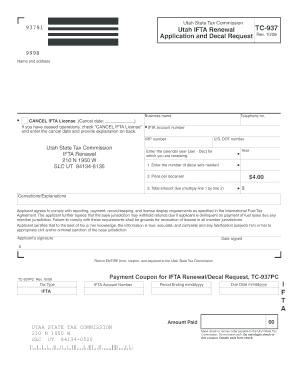

The TC-937 is an essential form used for the Utah International Fuel Tax Agreement (IFTA) renewal application and decal request. This guide will walk you through the process of filling out the form online, ensuring a smooth and accurate submission.

Follow the steps to effectively complete the TC-937 online.

- Click ‘Get Form’ button to obtain the TC-937 and open it in your preferred editing tool.

- In the 'Name and address' section, fill in your business name, address, telephone number, IFTA account number, and U.S. DOT number.

- If applicable, indicate your intention to cancel your IFTA license by checking ‘CANCEL IFTA License’ and providing a cancel date along with explanations on the back.

- Enter the calendar year for which you are renewing in the designated field.

- In the section for decals needed, specify the number of decal sets required based on the units owned or leased by your company.

- Fill in the price per decal set, which is $4.00, and calculate the total amount due by multiplying the number of decal sets by the price.

- Review the 'Corrections/Explanations' section to ensure accuracy in your information; sign and date the application to certify its correctness.

- Once completed, ensure that you save your changes. You can then download, print, or share the form as necessary.

Complete your TC-937 online and submit it to ensure timely processing of your IFTA renewal.

Fuel Tax Rates Tax TypeTax RatesEffective DatesMotor and special fuels (except as listed below)$0.30 per gallonJan 1, 2019 – Dec 31, 2019$0.294 per gallonJan 1, 2016 – Dec 31, 2018$0.245 per gallonJul 1, 1997 – Dec 31, 2015Electricity and PropaneExemptEffective Jan 1, 200919 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.