Loading

Get Ace Liquor Liability Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ACE Liquor Liability Application online

Filling out the ACE Liquor Liability Application is an essential step for businesses seeking liquor liability insurance. This guide provides comprehensive instructions to help ensure the process is straightforward and efficient.

Follow the steps to complete the application accurately.

- Click ‘Get Form’ button to obtain the ACE Liquor Liability Application and open it in your preferred online document editor.

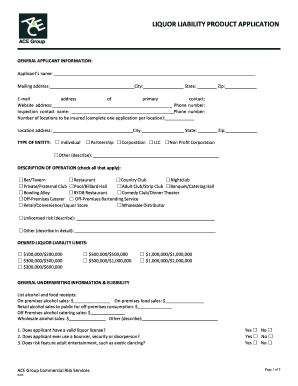

- Begin with the general applicant information section. Fill in your name, mailing address, city, state, zip code, email address of the primary contact, website address, phone number, and the name and phone number of the inspection contact. Specify the number of locations to be insured, ensuring to complete a separate application for each location.

- Next, indicate the type of entity that applies to your business. Select from options such as individual, partnership, corporation, LLC, non-profit corporation, or other; if you choose 'other,' be sure to describe it in the provided space.

- In the description of operation section, check all boxes that accurately reflect your business type, such as bar/tavern, restaurant, nightclub, etc. Ensure all applicable categories are selected to give a full picture of your operations.

- Specify your desired liquor liability limits by selecting from the provided options, which range from $100,000/$200,000 up to $1,000,000/$2,000,000. Choose the limit that best suits your business needs.

- Enter details for the general underwriting information and eligibility section. This includes listing your monetary figures for alcohol and food receipts for on-premises sales, off-premises sales, and any additional relevant financial data.

- Respond to the series of yes/no questions regarding your operation, such as whether you have a valid liquor license or if you use entertainment at your venue. Ensure that responses are accurately indicated as these affect eligibility.

- Provide any specific details required for sections relating to any entertainment featured at your location, experience in managing similar operations, as well as details on alcohol serving practices and past violations if applicable.

- Complete any additional sections pertinent to unlicensed operations, BYOB policies, or catering events as required by your type of establishment.

- Finally, review all sections of the application for completeness and accuracy. Ensure that all required signatures are obtained and dated. Once finalized, you can save changes, download a copy, print, or share the completed application as needed.

Take the next step in securing your liquor liability insurance by completing the ACE Liquor Liability Application online today!

The liquor liability exclusion in the CGL policy eliminates coverage for insureds that are “in the businesses” of manufacturing, distributing, selling, serving, or furnishing alcoholic beverages.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.