Loading

Get Trsl Application For Refund.pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TRSL Application For Refund.pdf online

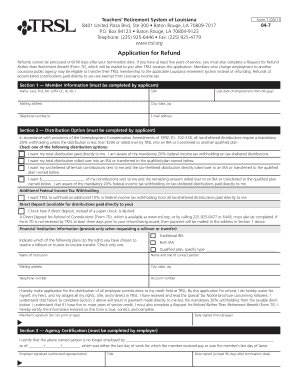

Filling out the TRSL Application For Refund is a straightforward process that helps users request a refund of their accumulated contributions. This guide provides step-by-step instructions to assist you in completing the application online with confidence.

Follow the steps to fill out your application successfully.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- In Section 1, enter your member information. This includes your full name (last, first, middle initial, and any suffix), social security number, mailing address, city, state, zip code, telephone number(s), email address, and your last date of employment (formatted as mm-dd-yyyy).

- Proceed to Section 2 to choose your distribution option. You have several choices to indicate how you prefer to receive your refund, including payment directly to you or a rollover into an IRA or another qualified plan. Make sure to check the appropriate box for your selection.

- If you choose to have your total distribution paid directly to you, acknowledge the mandatory 20% federal income tax withholding by checking the corresponding box. You may also indicate if you wish for additional federal income tax withholding.

- For those choosing a rollover or transfer, provide the financial institution information, including the name of the institution, contact person, mailing address, telephone number, and account number.

- At the end of Section 2, ensure that you read and understand the statement regarding the waiver of rights and the consequences of not completing this section.

- In Section 3, your employer must certify your termination. They will provide the name of the agency, the date of your employment termination, and their signature, title, and date signed. This section must be completed at least 90 days after your termination date.

- Once all sections are completed, review the form for accuracy. Save your changes, and you can then download, print, or share the form as needed.

Start completing your TRSL Application For Refund online now.

Your TRSL benefit is paid to you for your entire life, and is calculated using three factors: 1. your years of TRSL service credit, 2. your final average compensation (FAC), and 3. a benefit factor (2.0% or 2.5%).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.