Loading

Get 2014 Pa-41 Schedule D - Sale

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2014 PA-41 Schedule D - Sale online

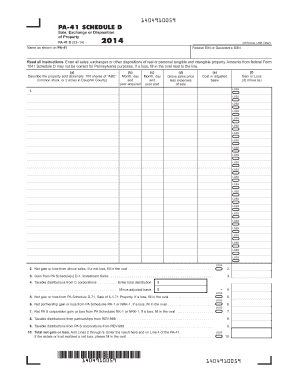

Filling out the 2014 PA-41 Schedule D - Sale can seem daunting. However, this step-by-step guide will support you in providing accurate information about the sale or exchange of property while ensuring you understand each section of the form.

Follow the steps to successfully complete the online form.

- Click the ‘Get Form’ button to access the form and open it in your browser.

- Begin by entering your name as it appears on the PA-41 form in the designated field.

- Input your Federal Employer Identification Number (EIN) or the decedent's Social Security Number (SSN) where indicated.

- Carefully read the instructions provided. You will need to document all sales, exchanges, or other dispositions of real or personal property.

- Describe the property that you sold in the first column (a). Provide a clear description, such as '100 shares of ABC common stock' or '2 acres in Dauphin County.'

- In columns (b) and (c), enter the month, day, and year the property was acquired and the month, day, and year it was sold.

- In column (d), input the gross sales price minus any expenses associated with the sale.

- Complete column (e) by stating the cost or adjusted basis of the property.

- In column (f), calculate the gain or loss by subtracting the amount in column (e) from the amount in column (d).

- Repeat steps 5 to 9 for each additional sale, noting losses as necessary.

- At the end of the table, evaluate the total net gain or loss by adding the amounts from lines 2 through 9, and enter the result in line 10.

- After completing the form, save your changes, and you have options to download, print, or share the completed form.

Complete your 2014 PA-41 Schedule D - Sale form online today to ensure your tax obligations are managed efficiently.

Related links form

A PA-41 Schedule RK-1 is also used to report the income of the estate or trust for each beneficiary that is a nonresident estate or trust and each nonresident partnership, PA S corporation or entity formed as a limited liability company classified as a partnership or PA S corporation for federal income tax purposes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.