Loading

Get Srp Cool Cash Rebate Program - Save With Srp

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SRP COOL CASH REBATE PROGRAM - Save With SRP online

This guide offers a detailed overview of how to accurately fill out the SRP COOL CASH Rebate Program application form online. By following these instructions, you can ensure that your rebate application is completed efficiently and correctly.

Follow the steps to fill out the SRP COOL CASH Rebate Program application form online.

- Press the 'Get Form' button to access the rebate application form and open it for completion.

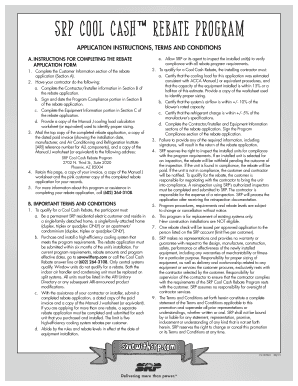

- Begin by filling out the Customer Information section (Section A) of the application form. Provide your account number, email address, name, mailing address, installation address, phone numbers, and home type.

- Have your contractor complete Section B, which includes their company name, address, daytime phone number, license number, and installation date. They must also sign and certify program compliance.

- In Section C, the contractor needs to provide Equipment Information. This includes details of the old equipment and the new high-efficiency systems installed, along with the ARI reference number.

- Once all sections are complete, collect the necessary documents: a dated paid invoice, a copy of the Manual J cooling load calculation worksheet (or equivalent), and the completed rebate application.

- Mail the top copy of the completed application and the additional documentation to the specified address: SRP Cool Cash Rebate Program, 2702 N. Third St., Suite 2020, Phoenix, AZ 85004.

- Retain copies of your application, invoice, and Manual J worksheet for your records.

- For further information or assistance, contact the SRP Cool Cash Rebate answer line at (602) 264-3108.

Start completing your rebate application online now to take advantage of the SRP COOL CASH Rebate Program.

If you added insulation to your home in 2022 (or before): You can receive a tax credit of up to 10% the cost of the materials. If you insulation in 2023 (or after): The insulation tax credit covers up to 30% of the costs associated with installing insulation in your home—up to a maximum of $1,200 per year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.