Loading

Get Modification Of Promissory Note California

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Modification Of Promissory Note California online

The Modification Of Promissory Note is a crucial document that allows borrowers and lenders to amend the terms of an existing loan agreement. This guide provides clear instructions on how to complete this document online, ensuring a smooth and efficient process.

Follow the steps to successfully fill out the Modification Of Promissory Note California.

- Click ‘Get Form’ button to access the form and open it in your preferred editor for easy completion.

- Provide the date of the modification at the top of the form. This should be the current date when you are making the modification.

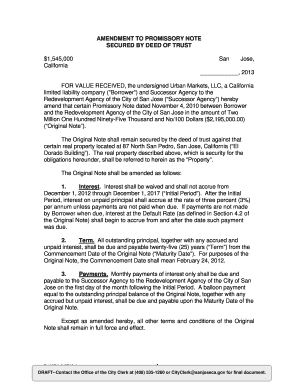

- Fill in the details of the borrower. Enter the full legal name of the borrower, in this case, Urban Markets, LLC, indicating its status as a California limited liability company.

- Specify the name of the agency involved, which is the Successor Agency to the Redevelopment Agency of the City of San Jose. This identifies the lender in this modification.

- Reference the original promissory note. Include details such as the date of the original note, which is November 4, 2010, and the original amount of $2,195,000. This clarifies which agreement is being modified.

- Detail the amendments made. Clearly state each change, starting with interest terms. Note the interest waiver period and the applicable interest rate following this period.

- Indicate the term of the loan. Confirm that the outstanding principal and interest will be due in a specific number of years, in this case, twenty-five years from the commencement date.

- Outline the payment structure, specifying that monthly interest payments will commence after a defined initial period and detailing any balloon payment expected at maturity.

- Include any additional clauses or stipulations relevant to the modification, ensuring clarity on how the modified terms will interact with the original note.

- Finalize the document by including spaces for signatures from all parties involved, ensuring representatives from both the borrower and the successor agency sign and date the document appropriately.

Begin your document modification by completing the Modification Of Promissory Note online now.

Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money. Generally, they also state due dates for payment and an agreed-upon interest rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.