Loading

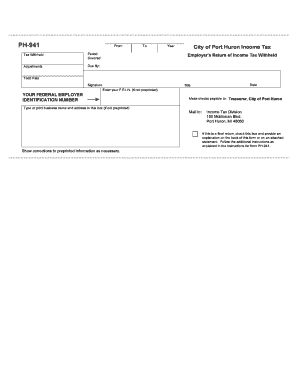

Get Ph941 Port Huron Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ph941 Port Huron Form online

This guide provides clear instructions on how to complete the Ph941 Port Huron Form online. Following these steps will help ensure that your form is filled out accurately and submitted correctly.

Follow the steps to complete the Ph941 Port Huron Form online.

- Click ‘Get Form’ button to access the Ph941 Port Huron Form and open it in your online editor.

- Begin by entering your Federal Employer Identification Number (F.E.I.N.) in the designated space, if it is not already preprinted on the form.

- Type or print your business name and address in the provided box, ensuring accuracy.

- Indicate the period covered by the form, ensuring that the dates align with your tax reporting requirements.

- If applicable, show any corrections to preprinted information directly on the form.

- If this is a final return, mark the appropriate box and provide an explanation on the back or attached statement.

- Complete the total paid section, providing accurate financial information.

- Review all entries carefully for accuracy before proceeding to submit.

- Once all fields are completed and verified, save changes, download a copy, and/or print the form to ensure you have a record.

Complete your Ph941 Port Huron Form online today to ensure timely submission.

Local income tax might be withheld on wages you earn inside city, county, and school district boundaries. If you live or work in an area that levies a tax, your wages will be taxed by that jurisdiction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.