Loading

Get Fatca Declaration For Active Non Financial Foreign Entities Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fatca Declaration For Active Non Financial Foreign Entities Form online

This guide provides clear instructions on how to accurately complete the Fatca Declaration for Active Non-Financial Foreign Entities Form online. It is designed to assist users of varying experience levels in navigating the form's components.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the Fatca Declaration for Active Non-Financial Foreign Entities Form and open it in the editor.

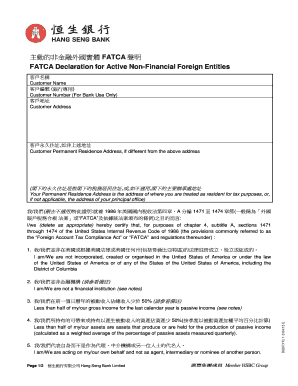

- Begin filling in the customer information section. Enter the 'Customer Name' as per your official documents. Ensure that the spelling matches precisely to avoid any discrepancies.

- Provide the 'Customer Number' as designated by the bank. This field is for bank use only and may be left blank if it does not apply to you.

- Fill in the 'Customer Address' accurately. This is where you will receive correspondence regarding your tax status.

- If your permanent residence address differs from the one previously entered, include it in the provided field along with clarification regarding its significance for tax purposes.

- Review the certification statements thoroughly. You must confirm that your entity is not incorporated in the United States and does not fall under the definition of a financial institution.

- Evaluate your income sources according to the criteria outlined in the form. Declare the percentage of passive income and assets as required, ensuring no section is overlooked.

- Complete the principal business activity section by describing the primary operations of your entity accurately.

- Ensure that the declaration of accuracy at the bottom of the form is completed, sign it, and provide the names and official positions of all signatories.

- Once all sections are finalized, save your changes, and choose to download, print, or share the completed form as necessary.

Start completing your documents online to ensure compliance with FATCA requirements.

An Active NFE generally refers to an entity that operates an active trade or business with <50% passive income (gross) or have <50% assets that produce passive income*. * Passive income includes dividends and interest.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.