Loading

Get Pre Action Letter Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pre Action Letter Template online

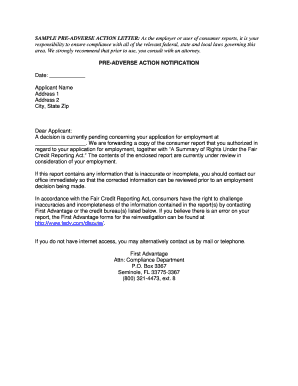

Filling out the Pre Action Letter Template is an essential step in ensuring compliance with relevant laws regarding consumer reports. This guide will walk you through each component of the form, enabling you to complete it efficiently and accurately.

Follow the steps to complete the Pre Action Letter Template online

- Click ‘Get Form’ button to access the Pre Action Letter Template and open it in your preferred online editor.

- Enter the date at the top of the document. This should reflect the current date on which you are sending the letter.

- Fill in the applicant's name, including any necessary details like middle initial or suffix, to ensure correct identification.

- Include the applicant’s complete address details, consisting of both Address 1 and Address 2 fields if applicable, followed by the city, state, and ZIP code.

- In the body of the letter, specify the organization name where the applicant applied for employment, ensuring accurate representation.

- Take care to mention that a decision regarding their application is pending, and note that a copy of the consumer report is enclosed with the letter.

- Include a paragraph inviting the applicant to contact your office if the report contains inaccuracies, highlighting the importance of correct information.

- List the contact information for First Advantage and any applicable credit bureaus, ensuring the applicants have clear instructions for further steps.

- Conclude the letter with a professional sign-off and the name of the sender. Leave space for any required signatures.

- Once all fields are complete and accurate, save changes to the document. You can then download the letter, print it, or share it as needed.

Complete and manage your Pre Action Letter Template online effortlessly today.

your name and address; concise detail of the claim; summary of the facts; if the claimant is seeking to recover debt then they should list all of these debts; a reasonable time limit for the defendant to reply, usually 14 days;

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.