Loading

Get Tulsa County Form 901

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tulsa County Form 901 online

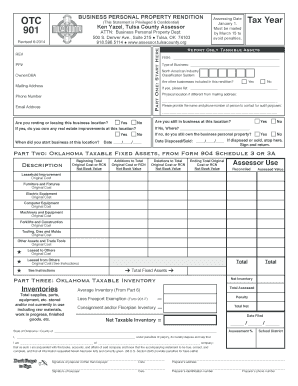

The Tulsa County Form 901 is a crucial document for businesses to report their personal property for tax purposes. This comprehensive guide will help you navigate the online filling process with ease, ensuring that you provide all necessary information accurately and efficiently.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part One, where you provide your details. Fill in the RE# and PP# with the assigned reference numbers. Enter your business name or DBA, mailing address, phone number, and email address.

- Indicate whether you are renting or leasing the business location by selecting 'Yes' or 'No'. If you answer 'Yes', you will need to specify if you own any real estate improvements at this location.

- Record the date you started your business at this location and note the assessing date, which is January 1. Make sure to keep in mind that the form must be submitted by March 15 to avoid penalties.

- Provide your FEIN and type of business. You will also need to indicate if other businesses are included in your rendition. If yes, list them accordingly.

- In Part Two, you will detail your Oklahoma taxable fixed assets. Report your beginning total, additions, and deletions with specific cost or replacement cost for items like furniture, equipment, and machinery.

- Continue to Part Three to report your taxable inventory. Provide the average inventory and total supplies, ensuring to complete any exemptions as necessary.

- In Part Four, document any additions made during the reporting year, detailing each item acquired and its original cost.

- Part Five is where you report any deletions made during the reporting year. List each item along with its acquisition year and original cost.

- Lastly, complete Part Six by recording your monthly inventory. Total the amounts and calculate the average.

- Finally, ensure you sign and date the form. If someone other than the taxpayer prepared the form, they must also sign and provide their details.

- Once all sections are completed, save your changes. You can then download, print, or share the completed form as needed.

Begin filling out your Tulsa County Form 901 online today for a smooth and efficient filing experience.

You may file in person at the Tulsa County Assessor's Office, Tulsa County Administration Building, Room 215, 500 S. Denver, Tulsa, OK 74103. You may also file by mail by downloading the Additional Homestead Exemption and/or Senior Valuation Limitation Form (available from Jan. 1st- March 15th only).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.