Loading

Get Loan Submission Form - Welcome-motive Lending

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Loan Submission Form - Welcome-Motive Lending online

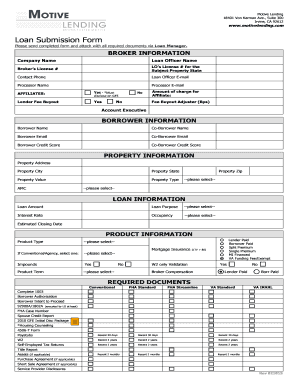

This guide provides a clear and supportive approach to filling out the Loan Submission Form for Welcome-Motive Lending. By following these steps, you will ensure that your submission is organized and complete, facilitating a smoother lending process.

Follow the steps to successfully complete your loan submission form.

- Use the ‘Get Form’ button to access the Loan Submission Form. This will allow you to open the form and begin filling it out.

- In the Broker Information section, enter the company name, loan officer's name, broker’s license number, loan officer’s license number for the subject property state, contact phone number, and email address for the loan officer. You should also include the name and email address of the processor.

- Indicate if you are working with affiliates. If applicable, check 'Yes' for the lender fee buyout and provide the amount of charge for the affiliate.

- Fill in the Borrower Information section with the names and email addresses of both the borrower and co-borrower. Include their respective credit scores as well.

- Provide the Property Information, including the address, city, state, zip code, property value, and type of property.

- Detail the Loan Information, specifying the desired loan amount, purpose of the loan, interest rate, occupancy type, and estimated closing date.

- Complete the Product Information section by selecting the product type, indicating if it is conventional or agency, and providing information about impounds and mortgage insurance options.

- Attach all Required Documents listed in the section depending on the type of loan, ensuring that you complete the necessary forms such as the borrower authorization and intent to proceed.

- Review all entered information for accuracy and completeness. Once satisfied, you may save your changes, download, print, or share the completed form according to your needs.

Complete your Loan Submission Form online today to streamline your lending experience.

Secured loans tend to have less stringent requirements and more favorable terms because the lender can take your collateral if you miss your loan payments. Some of the easiest loans to get in this category include auto title loans and pawnshop loans, but these also tend to be relatively expensive loans.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.