Loading

Get Flexible 401(k) Plan Automatic Enrollment Contribution ... - Paychex

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Flexible 401(k) Plan Automatic Enrollment Contribution Notice - Paychex online

This guide provides users with a step-by-step approach to successfully complete the Flexible 401(k) Plan Automatic Enrollment Contribution Notice. It ensures clarity and support throughout the process, making it accessible for everyone, regardless of their prior experience.

Follow the steps to fill out the form accurately and efficiently.

- Click ‘Get Form’ button to access the Flexible 401(k) Plan Automatic Enrollment Contribution Notice and open it for editing.

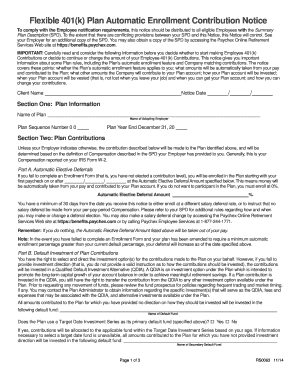

- Begin by filling out the 'Client Name' and 'Notice Date' sections accurately to ensure proper identification and documentation.

- In 'Section One: Plan Information', enter the 'Name of Plan' and 'Name of Adopting Employer.' Include the 'Plan Sequence Number' and 'Plan Year End' date.

- Proceed to 'Section Two: Plan Contributions.' Here, indicate your 'Automatic Elective Deferral Amount' based on your preferences for salary deferrals.

- Choose your investment options under 'Part B: Default Investment of Plan Contributions.' If you do not select an investment option, funds will go into a Qualified Default Investment Alternative.

- For 'Part C: Default Investment for Initial 90 Days', specify if a different default fund will apply during this time period, and if so, provide the fund name.

- Answer questions regarding the 'Automatic Elective Deferral Increase' in 'Part D'. Indicate if this provision applies and specify the increase percentage.

- In 'Part E: Permissible Withdrawals', review the conditions under which you can request a distribution of your elective deferrals, noting any key restrictions.

- For 'Part F: Safe Harbor Automatic Enrollment Employer Contributions,' determine if your plan complies with these requirements and select your chosen option.

- In 'Section Three: Vesting and Contributions', review the vesting rules and fill out any necessary details regarding employer contributions.

- Complete 'Section Four: Distributions' by indicating the forms and conditions under which you may access your funds.

- Finish with 'Section Five: Contact Information' to provide the name, address, and contact details of the Plan Administrator for further inquiries.

- Once all sections are completed, review the form to ensure accuracy before saving changes, downloading, printing, or sharing the document as required.

Complete your Flexible 401(k) Plan Automatic Enrollment Contribution Notice online today for a smoother retirement savings experience.

Late deposits may result in lost earnings and interest for employees' accounts. In addition, failing to deposit salary deferrals on a timely basis is a fiduciary violation and could subject the plan to the U.S. Department of Labor's (DOL's) civil penalties and could violate the plan's terms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.