Loading

Get Ca 00 01

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ca 00 01 online

Filling out the Ca 00 01 form, also known as the business auto coverage form, is an essential step for businesses seeking to ensure their auto-related risks are covered. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to successfully complete the Ca 00 01 form online.

- Click the ‘Get Form’ button to obtain the Ca 00 01 form and open it in your preferred editing program.

- Review the declarations section, which identifies the named insured, coverage limits, and effective dates. Ensure accuracy as this information is critical for your policy.

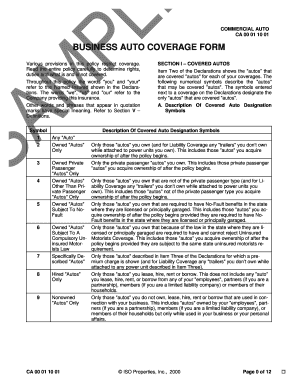

- In Section I, covered autos, select the appropriate symbols that represent the vehicles your business owns. Pay attention to the definitions of the symbols to determine which vehicles are covered.

- If you acquire new vehicles during the policy period, indicate these in Section B to ensure that they are covered under your policy as specified.

- Proceed to Section II, liability coverage, and fill in the required details about coverage responsibilities, ensuring that liabilities are well-defined according to your business needs.

- Complete Section III, which addresses physical damage coverage. Here, you'll specify additional coverage preferences, such as comprehensive and collision coverage, if applicable.

- Move to Section IV, business auto conditions, and ensure you understand all obligations you have as the insured, particularly regarding accident reporting and loss conditions.

- Review all the terms in Section V, definitions. Familiarize yourself with the specific terms, as they will help clarify your responsibilities under the policy.

- Once you've completed all sections, save your changes, then download, print, or share the form as needed to complete your submission.

Complete your Ca 00 01 form online today to ensure your business's vehicles are adequately protected.

California state law requires all commercial auto policies to have a minimum liability limit of $15,000 per person, $30,000 per accident for bodily injury and $5,000 for property damage (i.e., 15/30/5). Some policies are required to carry higher limits based on the types of vehicles they insure.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.