Loading

Get Annual Reconciliation Form.pub - The Village Of West Lafayette

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Annual Reconciliation Form.pub - The Village Of West Lafayette online

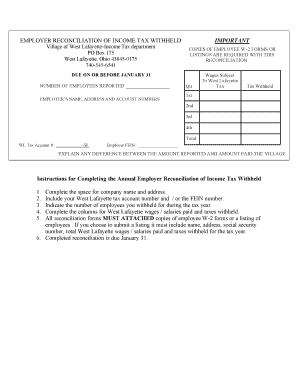

This guide provides clear instructions for completing the Annual Reconciliation Form for the Village of West Lafayette. By following these steps, users can efficiently prepare their reconciliation documents to ensure compliance and accuracy.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the Annual Reconciliation Form. This action will allow you to open the form in your preferred editor.

- In the designated space, enter your company name and address accurately. This ensures correct identification in the reconciliation process.

- Provide your West Lafayette tax account number along with your Employer Federal Employer Identification Number (FEIN) in the specified fields. This information is essential for processing your submission.

- Indicate the total number of employees for whom you withheld taxes during the tax year. This figure will assist in the assessment of your tax obligations.

- Fill in the columns detailing the total wages subject to West Lafayette tax and the corresponding tax amounts withheld for each quarter. Make sure these figures are accurate and reflect your financial records.

- Attach copies of employee W-2 forms or a comprehensive listing of employees with required details. If you opt for a listing, ensure it includes each person's name, address, Social Security number, total wages, and taxes withheld.

- Review all the information for accuracy before submitting. Once complete, you can save your changes, download the form, print it, or share it as necessary.

Start completing your Annual Reconciliation Form online today to meet the filing deadline.

Lafayette, California Sales Tax Rate 2023 The 9.75% sales tax rate in Lafayette consists of 6% California state sales tax, 0.25% Contra Costa County sales tax, 1% Lafayette tax and 2.5% Special tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.