Loading

Get Form No 10

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form No 10 online

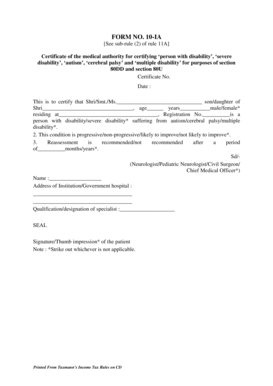

This guide provides a comprehensive overview of how to correctly fill out the Form No 10 online. This form is used to certify individuals as persons with disabilities for specific tax purposes, ensuring that they receive the necessary support and benefits.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, you will enter the name of the individual being certified. Fill in 'Shri/Smt./Ms.' followed by the person's full name.

- Next, specify the parent or guardian's name by entering 'son/daughter of' followed by their name.

- Indicate the person's age in years and whether they identify as male or female by selecting the appropriate option.

- Enter the full residential address of the individual being certified.

- Provide the registration number if applicable.

- Select the appropriate classification of disability by choosing from 'person with disability', 'severe disability', or the relevant condition such as 'autism', 'cerebral palsy', or 'multiple disability'.

- Determine if the condition is progressive, non-progressive, likely to improve, or not likely to improve, and make the appropriate selection.

- Indicate whether reassessment is recommended or not, and if it is recommended, specify the time period in months or years.

- Fill in the name and designation of the certifying specialist, such as a neurologist or civil surgeon, and their corresponding address.

- Ensure that the signature or thumb impression of the patient is included in this section.

- Review all entries for accuracy, then save your changes. You can also download, print, or share the completed form as needed.

Complete your documents online today to ensure timely processing and support.

Filing of Form 10 by a trust or institution who seeks exemption u/s 11 or u/s 12 is required when it wants to accumulates income . Thus section 11(2) of the Income Tax Act makes it mandatory for all persons claiming tax exemption us.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.