Loading

Get Va Form 802 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Va Form 802 Fillable online

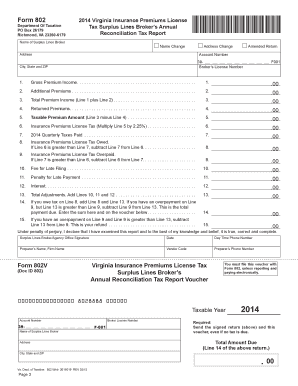

Completing the Virginia Surplus Lines Broker’s Annual Reconciliation Tax Report, or Va Form 802, is essential for licensed surplus lines brokers to meet their tax obligations. This guide provides clear, step-by-step instructions for filling out the form online, ensuring a smooth filing process.

Follow the steps to complete the Va Form 802 Fillable online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your taxpayer information by filling in your name, mailing address, Virginia Insurance Premiums License Tax account number, and Virginia broker’s license number in the spaces provided.

- Check the appropriate box if you have an address change or are filing an amended report.

- For Line 1, enter the gross amount of all premiums, assessments, dues, and fees collected from policies for insureds whose home state is Virginia.

- On Line 2, indicate the amount of premiums written for additional insurance coverage as a result of an insurance rider or rate adjustment.

- Add the amounts from Line 1 and Line 2, and enter the total on Line 3.

- On Line 4, enter the portion of premiums returned to an insured due to a rider, cancellation, or rate adjustment.

- Subtract Line 4 from Line 3, the result goes on Line 5 as the taxable premium amount.

- For Line 6, calculate the Insurance Premiums License Tax liability by multiplying the amount on Line 5 by 2.25 percent.

- Enter the total quarterly Insurance Premiums License Tax amount paid during the year on Line 7.

- If Line 6 is greater than Line 7, subtract Line 7 from Line 6 and enter the amount on Line 8. If Line 7 is greater than Line 6, enter that amount on Line 9.

- Complete Lines 10 through 15 according to the instructions provided, which include fees and penalties for late filing and payment.

- Finally, sign and date your report, then save your completed form. You can download, print, or share it as needed.

Start completing your Virginia Surplus Lines Broker’s Annual Reconciliation Tax Report online today!

Related links form

Virginia Tax has been charged with the administration and collection of premiums license tax forms and payments. This tax is imposed on all insurers and surplus lines brokers that are licensed in this Commonwealth by the State Corporation Commission's Bureau of Insurance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.