Loading

Get Pre Application Worksheet Mortgage

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pre Application Worksheet Mortgage online

Filling out the Pre Application Worksheet Mortgage online can streamline your mortgage application process. This guide will provide you with clear, step-by-step instructions to ensure that each section of the form is completed accurately and efficiently.

Follow the steps to successfully complete the Pre Application Worksheet Mortgage online.

- Click the ‘Get Form’ button to obtain the Pre Application Worksheet Mortgage and open it in your editor.

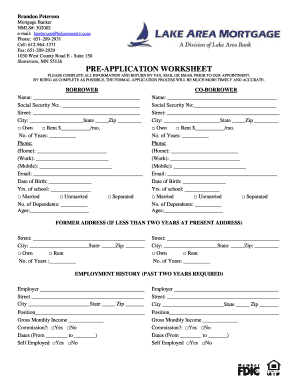

- Begin with the borrower section. Enter the full name, social security number, address, city, state, and zip code. Indicate whether you own or rent your residence, along with the monthly rent amount and the number of years at this residence.

- Provide your contact information, which includes home, work, and mobile phone numbers, as well as your email address. Fill in your date of birth, years of school completed, marital status, number of dependents, and their ages.

- If applicable, move on to the co-borrower section. Repeat the process by providing the co-borrower’s information including name, social security number, address, and contact details.

- If you have been at your current address for less than two years, provide your former addresses alongside the ownership status and duration of residence.

- Complete the employment history section, detailing your employment for the past two years, including employer information, job position, gross monthly income, and self-employment status.

- Continue with previous employer information if you have changed jobs within the last two years.

- List any other sources of income, if desired, including alimony or child support.

- Fill in asset account information, noting the institution name, account type, and current balances.

- Detail any vehicles owned by providing the year, make, model, and value.

- List other assets such as retirement accounts and additional real estate owned, specifying details as required.

- Finally, review the authorization to obtain credit section and sign with the date.

- Once all sections are completed, save your changes, and download or print the form for submission.

Complete your Pre Application Worksheet Mortgage online today for a smoother mortgage process.

your last three months' payslips. passport or driving license (to prove your identity) bank statements of your current account for the last three to six month. statement of two to three years' accounts from an accountant if self-employed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.