Loading

Get Tax Preparer Client Questionnaire

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Preparer Client Questionnaire online

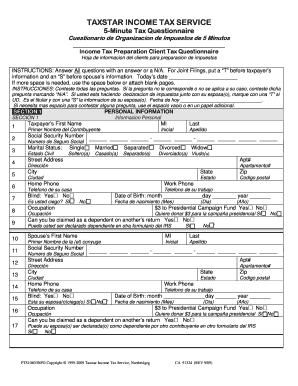

Filling out the Tax Preparer Client Questionnaire online can help streamline the tax preparation process, ensuring that you provide all necessary information accurately. This guide will walk you through each section of the form to help you complete it with confidence.

Follow the steps to successfully complete the questionnaire.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin with SECTION 1: Personal Information. Provide your first name, middle initial, last name, and Social Security Number. Indicate your marital status and fill in your street address, city, state, and zip code. Include your home and work phone numbers, date of birth, and occupation. If applicable, indicate if you want to donate $3 to the Presidential Campaign Fund.

- Complete the spouse’s information in the same section if you are filing jointly. Include their personal details and specify if they can be claimed as a dependent.

- Proceed to SECTION 2: Filing Status. Select your appropriate filing status by marking single, married filing jointly, or other applicable options. If married, provide your spouse's name and Social Security Number.

- In SECTION 3: Dependent Information, enter details for each dependent, including their name, Social Security Number, date of birth, relationship to you, and gross income for the applicable year.

- In SECTION 4: Income, answer questions regarding your income sources such as Social Security benefits, interest income, and business income. Provide amounts for each income source as applicable.

- Proceed to SECTION 5: Deductions. Indicate if you have child care expenses, student loan interest deductions, or IRA deductions. Provide details and amounts where needed.

- In SECTION 6: General Questions, answer questions about your last year’s filing, whether you owe back taxes, or any student loans. Mark appropriate fields.

- Complete SECTION 7: Refund Information. Indicate how you wish to receive any potential refund. Provide bank account details if you want direct deposit.

- Finally, acknowledge the accuracy of the information provided by signing and dating the form. Ensure all pages are filled accurately and completely.

- Review your completed questionnaire for accuracy. Once finished, you can save changes, download, print, or share the form as needed.

Complete your Tax Preparer Client Questionnaire online today to ensure a smooth tax preparation process.

In most cases, income, filing status and age determine if a taxpayer must file a tax return. Other rules may apply if the taxpayer is self-employed or if they are a dependent of another person.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.