Loading

Get Michigan W4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Michigan W4 online

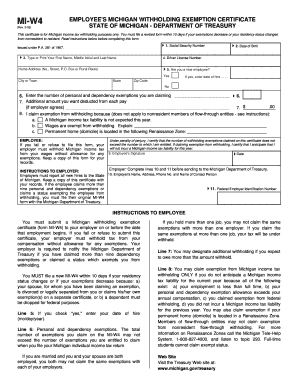

The Michigan W4 form, also known as the Michigan withholding exemption certificate, is essential for informing your employer about your tax withholding status. Accurately completing this form ensures that the appropriate amount of state tax is withheld from your paychecks.

Follow the steps to accurately complete the Michigan W4 online.

- Press the ‘Get Form’ button to access the Michigan W4 form and open it for completion.

- Enter your social security number in the designated field to confirm your identity.

- Type or print your first name, middle initial, and last name in the appropriate section to identify yourself clearly.

- Provide your driver license number, if applicable, as an additional form of identification.

- Fill in your complete home address, including street address, city or town, state, and zip code.

- Indicate whether you are a new employee by selecting yes or no. If yes, enter your date of hire.

- Enter the number of personal and dependency exemptions you are claiming, ensuring that this number does not exceed the exemptions you are entitled to.

- If applicable, specify any additional amount you wish to have deducted from each paycheck for withholding.

- Determine if you can claim exemption from withholding by checking the appropriate box and providing the necessary explanation if applicable.

- Sign and date the form to verify that the information provided is accurate and complete.

- After completing the form, save your changes. You may download, print, or share the form as needed.

Complete your Michigan W4 online today to ensure correct tax withholding from your paycheck.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.