Loading

Get Nar1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nar1 online

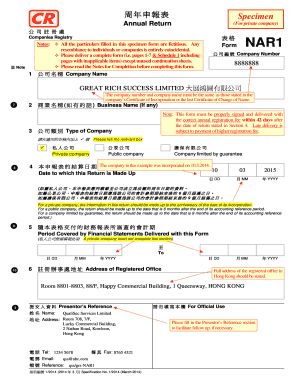

Filling out the Nar1 form online can seem daunting, but with this user-friendly guide, you will be equipped to complete it accurately and efficiently. This comprehensive guide will walk you through each section of the form, ensuring you have the necessary information to complete your annual return.

Follow the steps to complete your Nar1 form with ease.

- Click ‘Get Form’ button to obtain the Nar1 form and open it in your editor.

- Enter the company number and name in the corresponding fields. Ensure that these details match those on your Certificate of Incorporation.

- If applicable, fill in the business name that the company operates under.

- Select the type of company by ticking the appropriate box: Private company, Public company, or Company limited by guarantee.

- Specify the date to which this return is made up. For private companies, this is the anniversary of incorporation.

- If you are submitting financial statements, indicate the period covered by those statements (not required for private companies).

- Provide the address of the registered office in Hong Kong. Make sure it is the exact address as of the return date.

- Fill in the presentor's information to ease follow-up communication, including name, address, telephone number, and email.

- Report on any mortgages and charges, specifying the total amount of indebtedness as of the return date, or indicate 'NIL' if not applicable.

- Complete the share capital section only if applicable, detailing the class, number, and total amount of issued shares.

- Provide details of the company secretary, ensuring to fill in both personal and contact information.

- List all directors' information, including names, addresses, and identification details. Use continuation sheets if necessary.

- Complete the particulars of members section if the company has share capital, using required schedules if necessary.

- Declare the company's records location, if different from the registered office address.

- For private companies, complete the statement to confirm no shares or debentures have been offered to the public since the last return.

- Review all entered information for accuracy. Once complete, save your changes, and select whether to download, print, or share the form as needed.

Start filling out your Nar1 form online today to ensure compliance and avoid late fees.

Total late fees to be paid per day This means that in any case, the maximum late fees that can be charged by the Government is Rs 5,000 each return being filed under each Act. However, the maximum late fee has been rationalised from the June 2021 return period onwards, as given in the above section.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.