Loading

Get I. Antrag Auf Erteilung Einer Ans Ssigkeitsbescheinigung ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the I. Antrag Auf Erteilung Einer Ansässigkeitsbescheinigung online

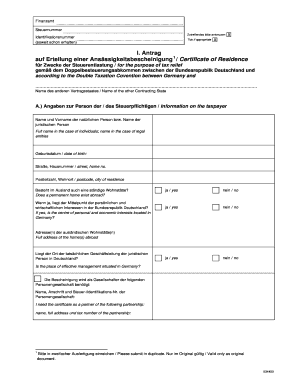

Filling out the I. Antrag Auf Erteilung Einer Ansässigkeitsbescheinigung online is essential for individuals and organizations seeking tax relief under the double taxation agreement between Germany and other countries. This guide will provide step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click the ‘Get Form’ button to download the form and open it in your preferred editor.

- In the top section, provide your 'Steuernummer' (tax number) and 'Identifikationsnummer' (identification number), if received.

- In section I, indicate whether the application is for a Certificate of Residence for tax relief by ticking the appropriate boxes.

- Fill in your full name under 'Name des Steuerpflichtigen' (name of the taxpayer) and enter your 'Geburtsdatum' (date of birth).

- Specify your address, including 'Straße, Hausnummer' (street, house number) and 'Postleitzahl, Wohnort' (postcode, city of residence).

- Answer whether you have a permanent home abroad and whether the center of your personal and economic interests is in Germany, ticking 'ja' (yes) or 'nein' (no) as applicable.

- Include the address of your foreign residence(s) if applicable.

- For legal entities, confirm if the effective management is based in Germany.

- Provide the details of the partnership for which the certificate is needed, including the full name, address, and tax identification number.

- In section B, indicate the type of income to be relieved from tax by listing it under 'Art der Einkünfte' (type of income) and the time of accrual.

- Fill in the 'Name und Anschrift des Schuldners der Vergütungen' (full name and address of the remuneration debtor) accurately.

- Provide the depositary bank details including the name and deposit number.

- Finally, sign the document, and ensure that you have filled it out entirely before submission.

- After completing the form, you can save changes, download, print, or share it as needed.

Complete your documents online to ensure a smooth application process.

Wie lange ist eine Ansässigkeitsbescheinigung gültig? Die Ansässigkeitsbescheinigung behält für 365 Kalendertage ihre Gültigkeit. Der Gültigkeitszeitraum beginnt mit dem Tag, an dem das zuständige Finanzamt die steuerliche Ansässigkeit des Sparers bestätigt.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.