Loading

Get Vat 201 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat 201 Form online

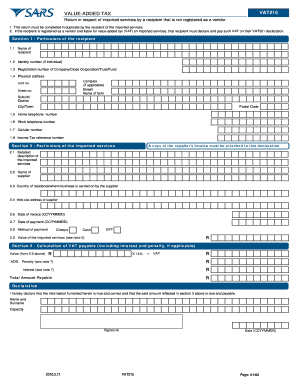

Filling out the Vat 201 Form online is an essential task for people who receive imported services and are not registered as vendors. This guide provides clear, step-by-step instructions to help users navigate the process effectively.

Follow the steps to complete the Vat 201 Form online

- Click ‘Get Form’ button to obtain the Vat 201 Form and open it in the editor.

- In Section 1, fill in the particulars of the recipient. Provide your name, identity number (if you are an individual), or registration number if you represent a company or trust. Also, include your physical address along with your contact numbers and income tax reference number.

- Move to Section 2 where you need to provide particulars of the imported services. Attach a copy of the supplier's invoice, then describe the services, provide the supplier's name, their country of residence, and their website address. Additionally, fill in the date of the invoice and the payment date, and indicate the method of payment used.

- In Section 3, calculate the VAT payable. Take the value of the imported services stated in Section 2 and multiply it by 14% to determine the VAT amount. Add any penalties or interest if applicable to find the total amount payable.

- Finally, complete the declaration by confirming that all information provided is accurate. Sign and date the form before submitting it to the appropriate authority.

- Once you have filled out the form completely, save the changes, and download or print your completed form for your records.

Get started with completing your Vat 201 Form online today.

Manual – submission of the VAT201 and payment must be done by 25th of the month. It should be noted that each vendor may be on a different VAT cycle. Electronic (e-filing) – submission and payment of the VAT201 must be done by the last business day of the month.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.