Loading

Get Form 12b.xls. Notification Of Late Filing

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 12B.xls. Notification Of Late Filing online

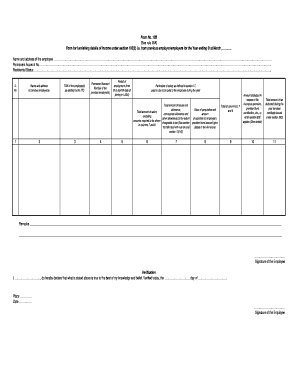

Filling out the Form 12B.xls. Notification Of Late Filing is essential for reporting your income details under section 192(2) related to previous employment. This guide will assist you in completing the form online with ease and accuracy.

Follow the steps to accurately complete the Form 12B.xls.

- Click the ‘Get Form’ button to obtain the form, and open it in your selected online editor.

- Enter your name and address in the designated section, ensuring all details are accurate and current.

- Provide your Permanent Account Number (PAN) in the respective field, which is required for tax identification.

- Indicate your residential status as per the options provided in the form.

- For each previous employer, list their name and address in the appropriate fields, ensuring no employer is left out.

- Fill in the Tax Deduction and Account Number (TAN) for each employer as assigned by the Income Tax Office.

- Complete the Permanent Account Number (PAN) section for each previous employer to ensure correct identification.

- Indicate the period of employment by specifying the start date and the end date when joining the current employment.

- Detail your salary particulars, including house rent allowance, conveyance allowance, and other necessary allowances applicable as specified.

- List the value of perquisites and any amount added to your provident fund account, providing additional details in the annexure if necessary.

- Sum up the values in columns six, seven, and eight to reflect your total salary and allowances.

- Record any deductions applicable under section 80C, including life insurance premiums and provident fund contributions.

- Document the total amount of tax deducted throughout the year and ensure you attach the required certificate as per section 203.

- Include any remarks or additional notes in the designated remarks section, if needed.

- Sign the form and provide the verification details, including your name and date of verification.

- Finally, save your changes, download a copy for your records, and prepare to print or share the completed form as required.

Ensure your documents are complete by following these steps online.

Form 12B is an income tax form issued by the Income Tax Department of India which is to be submitted by an employee joining an organization in the middle of the year. This is in ance with Rule26A of the Income Tax act.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.