Loading

Get Joint Or Single Application - Mortgage Professor

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Joint Or Single Application - Mortgage Professor online

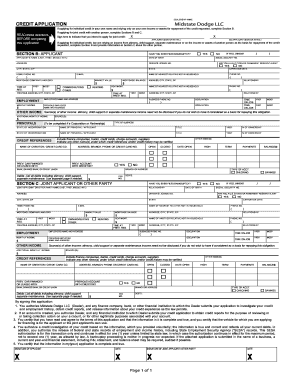

Filling out the Joint Or Single Application - Mortgage Professor is an essential step for obtaining credit for your vehicle purchase. This guide will lead you through each section of the application, ensuring you provide all necessary information accurately.

Follow the steps to complete the Joint Or Single Application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Section B: Applicant. Provide the applicant's name, date of birth, address, driver's license number, and contact information. If applicable, indicate if you have ever filed for bankruptcy.

- Fill in details about your current living situation by selecting either renting or owning/buying. Also, include your monthly income and employment history.

- If applying for joint credit, proceed to Section C: Joint Applicant or Other Party. Enter the joint applicant's information including name, date of birth, address, driver’s license number, and their monthly income.

- Both applicants must sign or initial in the designated areas to indicate their intention to apply for joint credit. This step is crucial for joint applications.

- Continue providing necessary details regarding credit references and any existing debts. Be thorough to ensure an accurate assessment of your creditworthiness.

- Finally, review all entries for accuracy. After confirming that all information is correct, you may save your changes, download, print, or share the completed form as needed.

Complete your Joint Or Single Application online today to take the first step towards financing your vehicle.

Joint credit is any type of debt that is owned and owed by two or more people. Two or more individuals may consider applying for joint credit if they're getting married or co-signing a mortgage. ... In order to obtain joint credit, each party must submit their personal information on a credit application.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.