Loading

Get Welfare Exemption First Filing - Assessor-county Clerk-recorder

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Welfare Exemption First Filing - Assessor-County Clerk-Recorder online

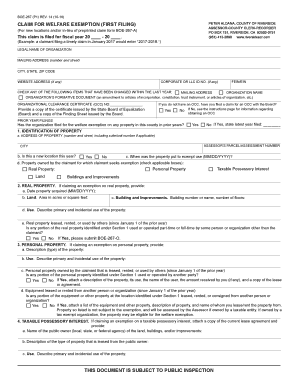

Filling out the Welfare Exemption First Filing form accurately is essential for organizations seeking property tax exemptions. This guide will provide you with clear, step-by-step instructions to ensure your online submission is complete and correct.

Follow the steps to complete your welfare exemption form online.

- Click the ‘Get Form’ button to access the Welfare Exemption First Filing form and open it for editing.

- Indicate the fiscal year for which you are filing the claim in the designated field. Use the format ‘YYYY-YYYY’, for example, ‘2023-2024’ for claims filed now.

- Enter the legal name of your organization in the specified field, along with the mailing address, city, state, and ZIP code.

- If applicable, provide your corporate or LLC ID number, along with your Federal Employer Identification Number (FEIN) or Employer Identification Number (EIN).

- Review and check any items that have changed within the last year, such as the mailing address or organization name. If changes are checked, ensure you have the needed documentation.

- Complete the identification of property section where you must provide the address and assessor’s parcel number for the property seeking exemption. Indicate if this is a new location.

- Fill in the date the property was put to exempt use, specifying which type of property (personal property, real property, etc.) is being claimed.

- For real property exemptions, provide information regarding the property acquisition date, area of the land, building details, and usage description.

- Complete the personal property section only if claiming exemption on personal property, detailing the type and use of the property.

- If applicable, attach relevant financial statements and any additional required documentation based on your specific claims.

- Finally, review all entered information for accuracy, sign the form where required, and submit it ensuring to save any changes. Options to download, print, or share the form may be available upon completion.

Begin your online filing process now to claim your welfare exemption.

If you own a home and it is your principal place of residence on January 1, you may apply for an exemption of $7,000 from your assessed value. New property owners will automatically receive a Homeowners' Property Tax Exemption Claim Form (BOE-266/ASSR-515).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.