Loading

Get Request For Transcript Of Tax Return 4506-t - Pennsylvania ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Request For Transcript Of Tax Return 4506-T - Pennsylvania online

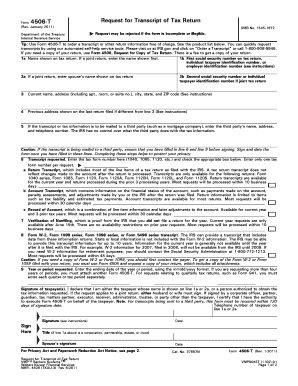

Filling out the Request For Transcript Of Tax Return 4506-T is a straightforward process that allows individuals to request tax return information from the IRS. This guide provides clear, detailed instructions on how to complete this form online efficiently.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to access the form and open it in your preferred editing tool.

- In section 1a, enter the name shown on your tax return. If it is a joint return, enter the first name listed.

- If filing a joint return, enter your spouse's name in section 2a and their corresponding identification number in section 2b.

- Complete section 3 with your current address, ensuring to include any apartment, room, or suite numbers, along with city, state, and ZIP code.

- In section 4, provide your previous address if it differs from your current one in section 3.

- If the transcript is to be mailed to a third party, fill in line 5 with their name, address, and telephone number.

- In section 6, specify the tax form number you are requesting (like 1040, 1065) and check the appropriate box. Ensure to enter only one tax form number per request.

- Select the type of transcript you require in section 6, such as Return Transcript, Account Transcript, or Record of Account.

- Enter the year or period for which you are requesting the transcript using the mm/dd/yyyy format in section 9.

- Sign and date the form in section 8, ensuring that the signing is done by the taxpayer whose name appears on lines 1a or 2a. If the transcript is to be sent to a third party, ensure it's within 120 days of the signature date.

- Once the form is completed, save your changes. You can then download, print, or share the form as needed.

Complete your Request For Transcript Of Tax Return 4506-T online today for prompt processing.

Set up an account with the IRS. They will email you a confirmation code to enter. Be sure to check your junk file in case the email is sent there. Complete steps 1-6 to create an account. Be sure to select Return Transcript and the appropriate year. Print the Transcript and submit to Financial Aid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.