Loading

Get 31 103f1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 31 103f1 online

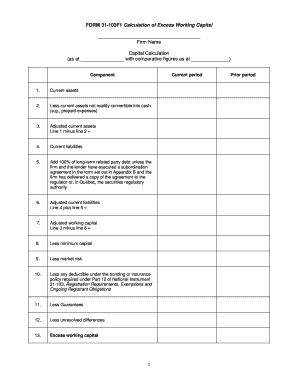

The 31 103f1 form, known as the calculation of excess working capital, is an essential document for financial firms that ensures compliance with capital requirements. This guide will provide you with clear, step-by-step instructions to fill out the form accurately and efficiently.

Follow the steps to complete the 31 103f1 form online.

- Press the 'Get Form' button to obtain the form and open it in the editing environment.

- Enter the firm name at the top of the form. This identifies the registered entity for which the capital calculation is being performed.

- In the capital calculation section, fill in the date for the current period and comparative figures by specifying the relevant dates.

- List the current assets in line 1. These include all liquid assets that you can quickly convert to cash.

- In line 2, subtract current assets that are not easily convertible into cash, such as prepaid expenses. Enter this amount to calculate adjusted current assets in line 3.

- Fill in line 4 with total current liabilities, which include all obligations that the firm needs to settle within the current period.

- For line 5, add 100% of long-term related party debt, unless there's a subordination agreement in place. This might require referencing the relevant documentation for accuracy.

- Calculate adjusted current liabilities in line 6 by adding the amounts from lines 4 and 5.

- Determine the adjusted working capital in line 7 by subtracting the adjusted current liabilities from adjusted current assets (line 3 minus line 6).

- For line 8, enter the minimum capital required for your firm type (e.g., $25,000 for an adviser).

- In line 9, calculate the market risk according to the instructions in Schedule 1, ensuring to use the fair values and margin rates applicable.

- Fill in line 10 with any deductible amounts under bonding or insurance policies as stipulated.

- List any guarantees in line 11, ensuring not to duplicate amounts already accounted for in line 4.

- Account for unresolved differences in line 12, based on the guidance provided, to ensure all potential losses are captured.

- Finally, calculate the excess working capital in line 13 by subtracting lines 8, 9, 10, 11, and 12 from line 7.

- After completing all fields accurately, save your changes. You can then download, print, or share the form as needed.

Complete your 31 103f1 form online to ensure your firm's compliance with capital requirements efficiently.

To calculate working capital requirements, you can use the formula mentioned below: Working Capital (WC) = Current Assets (CA) – Current Liabilities (CL).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.