Loading

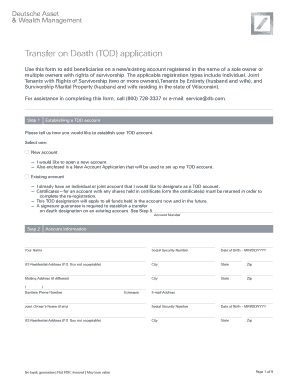

Get Transfer On Death (tod) Form - Deutsche Asset & Wealth Management

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Transfer On Death (TOD) Form - Deutsche Asset & Wealth Management online

This guide provides a comprehensive overview of how to complete the Transfer On Death (TOD) Form from Deutsche Asset & Wealth Management online. The TOD form allows users to establish beneficiaries for their accounts, ensuring a smooth transition of assets after their passing.

Follow the steps to complete the TOD form with ease.

- Click the ‘Get Form’ button to access the Transfer On Death form and open it in your preferred editor.

- Indicate how you would like to establish your TOD account. Choose either to create a 'New account' or use an 'Existing account'. If opting for an existing account, ensure you provide all necessary details alongside any required certificates and a signature guarantee if applicable.

- Designate your beneficiaries. You can add multiple primary beneficiaries and, if necessary, secondary beneficiaries. Each beneficiary must have their respective percentage share, totaling 100% for primary and 100% for secondary beneficiaries, if applicable.

- Read and agree to the terms outlined in the form. This section confirms your understanding of the transfer conditions, including your authority to designate beneficiaries and your acknowledgment of the Fund's rules.

- If applicable, complete the spousal consent section. If you are married and your spouse is not named as the sole beneficiary, their signature will be necessary to validate your designation.

- Review the completed form for accuracy and completeness. Once confirmed, you can save changes, download, print, or share the completed form as necessary.

Complete the Transfer On Death form online today to secure your beneficiaries' future.

A transfer on death, or TOD, is a designation that allows a creditor's assets to pass directly to their beneficiary after they die. The account owner specifies the percentage of assets each beneficiary is to receive, allowing their executor to distribute the assets without first passing through probate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.