Loading

Get Instruction For Copleting Rhode Island Up1 And Up2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instruction for Completing Rhode Island UP1 and UP2 online

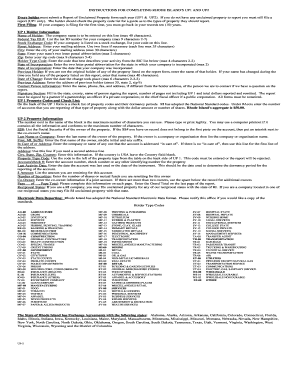

This guide aims to provide clear and concise instructions on how to complete the Instruction for Completing Rhode Island UP1 and UP2 forms online. Whether you are a seasoned professional or a first-time filer, this guide will assist you in navigating the process effectively.

Follow the steps to successfully complete your forms online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter Holder Information. Provide the name of the holder (company name), followed by the federal tax ID number and stock exchange code if applicable.

- Fill in the street address. If necessary, use two lines for the complete mailing address, while ensuring each line is within the character limit.

- Complete the city, state (using the two-letter postal abbreviation), and zip code fields. Ensure accuracy as this information is crucial for mailing purposes.

- Select the Holder Type Code that best describes your activity from the provided code list.

- Indicate the state of incorporation and the date of incorporation.

- If applicable, provide information about any previous holder of the reported property, including their name and address.

- Designate a contact person, providing their name, phone number, and fax number if different from the holder's address.

- Complete the signature section with the state, county, and name of the person signing, along with the total dollar amounts reported and the number of pages.

- On the UP1 property codes checklist, indicate the number of accounts being reported and the corresponding dollar amounts.

- Proceed to fill out the UP2 property information section accurately, ensuring all required fields such as SSN, last name, and address are filled in legibly.

- At the end of the form, verify all your entries, save your changes, and finalize by downloading, printing, or sharing the filled form as needed.

Complete your documents online today to ensure compliance with Rhode Island’s unclaimed property reporting requirements.

RESIDENT: a person (a) who is domiciled in the State of Rhode Island or (b) who, even though domiciled outside Rhode Island, maintains a perma- nent place of abode within the state and spends a total of more than 183 days of the taxable year within the state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.