Loading

Get Arizona Form 10193

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Arizona Form 10193 online

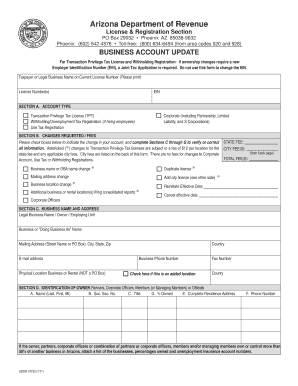

Filling out the Arizona Form 10193 is an essential step for updating your business account information with the Arizona Department of Revenue. This guide will provide you with clear instructions on completing the form accurately and submitting it online.

Follow the steps to expertly complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by reading the instructions on the form carefully. This ensures you understand what information is needed for each section.

- In Section A, select the appropriate account type by checking the box next to ‘Corporate’ if applicable or any other relevant options like Transaction Privilege Tax License or Use Tax Registration.

- Move to Section B to indicate the changes requested by checking the appropriate boxes. Note that asterisks (*) indicate changes that may incur a fee. Ensure to complete Sections C through G to verify or correct your information.

- In Section C, fill out the Business Name and Address details accurately. Include the Legal Business Name, Doing Business As (DBA) name, and correct mailing address.

- Proceed to Section D for identifying owners or corporate officers. Record their names, titles, and the percentage of ownership, along with complete residence addresses and phone numbers.

- If applicable, prepare to attach any additional documentation required. For instance, if ownership involves more than 50% in another business, include a list of those businesses with ownership percentages.

- Once you have filled out all sections, review the entire form for accuracy. Make any necessary corrections to ensure all information is complete.

- Finally, save your changes, and you will have the option to download, print, or share the form as needed.

Complete your Arizona Form 10193 online today for a hassle-free update of your business information.

Form 5000 - Arizona Transaction Privilege Tax Exemption Certificate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.