Loading

Get Tax Deferral Affidavit For Over65 Or Disabled Homeowner - Mcad-tx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TAX DEFERRAL AFFIDAVIT FOR OVER-65 OR DISABLED HOMEOWNER - Mcad-tx online

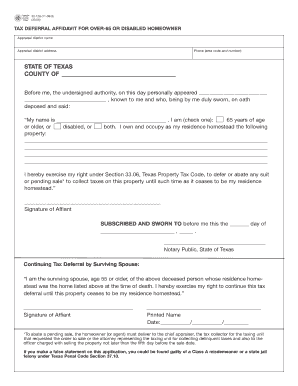

Filling out the TAX DEFERRAL AFFIDAVIT FOR OVER-65 OR DISABLED HOMEOWNER is an essential step for eligible homeowners to ensure they take advantage of tax deferment benefits. This guide will provide clear, step-by-step instructions tailored to help you complete this form online with ease.

Follow the steps to complete your Tax Deferral Affidavit online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering the appraisal district name at the top of the form. This is the name of the local government agency responsible for property taxes in your area.

- Next, provide the phone number of the appraisal district, including the area code. This information is useful for any follow-up inquiries.

- Fill in the appraisal district address, ensuring all details are accurate and complete.

- In the section that begins ‘STATE OF TEXAS, COUNTY OF’, enter the name of the county where your property is located.

- Identify yourself by writing your full name in the specified space, as you will be required to swear an oath in this document.

- Indicate your age or disability status by checking the appropriate box — either ‘65 years of age or older’, ‘disabled’, or ‘both’.

- Specify the address of the property you own and occupy. Ensure that this address matches the one associated with your homestead registration.

- Read the statement regarding your rights under Section 33.06 of the Texas Property Tax Code and confirm your understanding.

- Proceed to sign the affidavit next to your printed name, confirming your declarations.

- Leave the section for the notary public blank, as this will be filled out during the notarization process. You will need to sign the document in the presence of a notary.

- If applicable, complete the section for survivorship statements, indicating that you are the surviving spouse and have the right to continue the tax deferral.

- Once all sections are filled accurately, you have options to save, download, or print the completed form for your records or submission as needed.

Start completing your TAX DEFERRAL AFFIDAVIT online today to ensure you take advantage of your eligible benefits.

Related links form

Applying is free and only needs to be filed once. The application can be found on your appraisal district website or using Texas Comptroller Form 50-114. If you turn 65 or become disabled, you need to submit another application to obtain the extra exemption using the same Form 50-114.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.