Loading

Get Agency Certification Untaxed Income Verification

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AGENCY CERTIFICATION UNTAXED INCOME VERIFICATION online

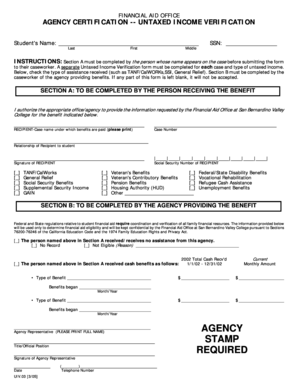

Filling out the AGENCY CERTIFICATION UNTAXED INCOME VERIFICATION form is an essential step in verifying untaxed income for financial aid eligibility. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the form online:

- Click ‘Get Form’ button to access the form and open it in your preferred digital editor.

- Begin by filling in the student's name in the designated fields for last name, first name, and middle name.

- Enter the student's Social Security Number (SSN) in the provided space.

- In Section A, the person receiving the benefit must complete their personal information, including case name and case number.

- Specify the relationship of the recipient to the student by filling in the appropriate section.

- The recipient must sign the form to authorize the necessary information for the Financial Aid Office.

- Next, check all applicable boxes that indicate the type of assistance received, such as TANF/CalWORKs, SSI, General Relief, and others.

- Once Section A is completed, proceed to Section B, where the agency providing the benefit must fill out their information.

- Confirm whether the recipient received assistance from the agency and provide details if applicable, including types of benefits and cash amounts.

- Fill in the beginning dates for any benefits received, specifying the month and year.

- The agency representative must print their full name, title, and official position, then sign and date the form.

- Finally, make sure to provide the agency's telephone number and affix the agency stamp where required.

Complete your documentation process online to ensure a smooth verification of untaxed income.

During verification, the college financial aid administrator will ask the applicant to supply copies of documentation, such as income tax returns, W-2 statements and 1099 forms, to verify the data that was submitted on the Free Application for Federal Student Aid (FAFSA).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.